T4K3.news

UK households warned of advanced financial scams

Individuals are being tricked into depositing cash by fraudsters impersonating Wise and similar firms.

A warning has been issued about sophisticated scams targeting UK bank account holders.

UK households facing advanced scams impersonating financial firms

A new warning highlights a wave of highly sophisticated scams affecting UK households. Fraudsters are impersonating reputable financial firms, such as Wise, to trick individuals into depositing cash. Reports indicate that victims receive enticing offers for fixed-rate savings accounts, promising high interest returns. Martin Richardson from the National Fraud Helpline described this as one of the most convincing scams observed. He explained how scammers utilize stolen personal details to create a façade of legitimacy, including answering security questions as the victim would. Wise has acknowledged the scams and is actively working to dismantle fraudulent operations.

Key Takeaways

"Once they have your details, they will instantly recognise your phone number and ask you to pass security questions."

Martin Richardson warns about the tactics used by scammers to manipulate victims.

"We’re aware of scams that use branding of financial services providers to deceive people into thinking they are holding their money."

Wise confirms the existence of impersonation scams affecting consumers.

The emergence of these scams exposes vulnerabilities within the financial sector and raises concerns about consumer trust. As technology advances, so do the methods employed by scammers, making it crucial for financial institutions to enhance customer security measures. This situation might compel banks and services like Wise to tighten their verification processes and increase awareness campaigns about potential threats to mitigate financial losses and protect their clients. In the face of escalating fraud rates, it remains essential for consumers to stay vigilant and informed about such dangers.

Highlights

- Scammers exploit trust with clever impersonation.

- This might be one of the most convincing scams ever.

- High interest rates lure victims into a trap.

- Fraudsters are adapting and becoming more sophisticated.

Serious risks of financial scams and public trust

The growing number of sophisticated scams poses significant risks for UK households, leading to financial losses and a decline in trust in financial institutions.

Ongoing efforts to combat these scams will be essential.

Enjoyed this? Let your friends know!

Related News

UK borrowing exceeds £20bn in June

Lloyds Bank warns of rising job scam risks

Rachel Reeves warned on banking regulation changes

Martin Lewis alerts UK households about market fluctuations

Miliband faces backlash over energy policy

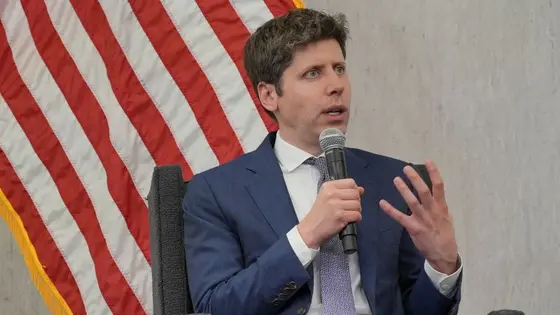

OpenAI CEO warns about AI fraud crisis

UK households warned about August bank holiday travel disruptions

Ray Dalio warns UK may be trapped in debt cycle