T4K3.news

Trump accuses Powell of financial mismanagement

Trump blames Jerome Powell for costing the nation billions in rising interest payments.

Trump accuses the Fed chair of costing the US billions by not cutting interest rates.

Trump blames Powell for rising interest costs

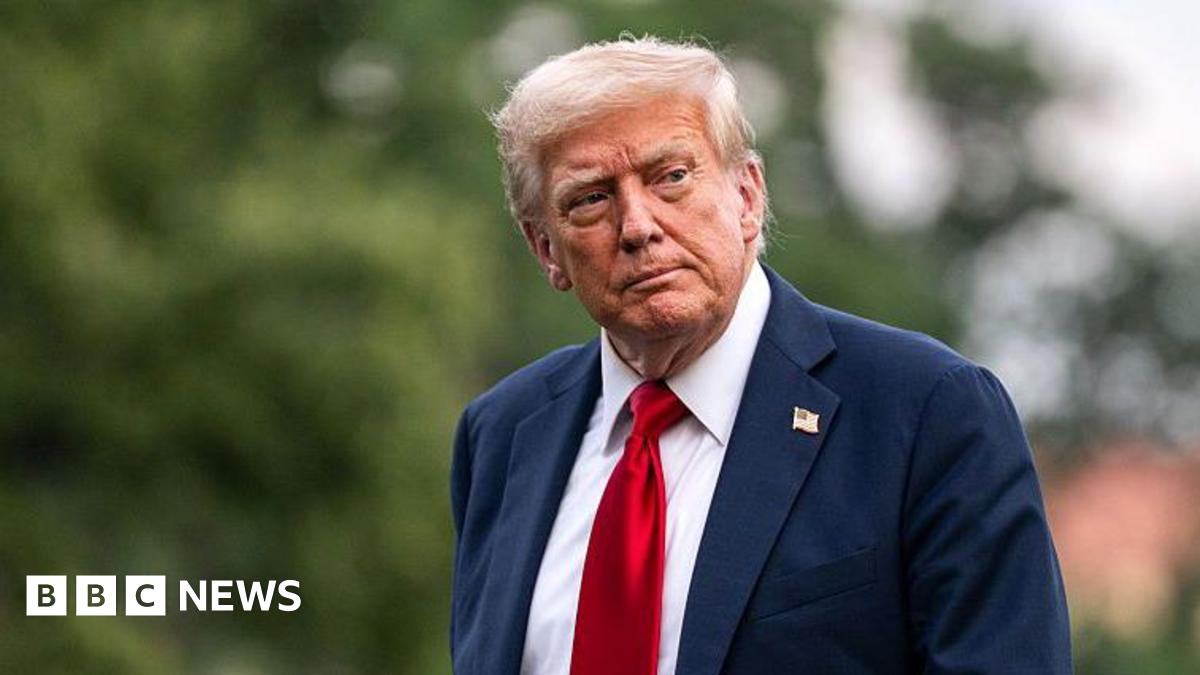

President Donald Trump has accused Federal Reserve Chair Jerome Powell of causing the United States to lose hundreds of billions of dollars by refusing to lower interest rates. In a recent post on Truth Social, Trump criticized Powell, stating, "You have cost the USA a fortune and continue to do so." Interest payments on the federal debt are projected to exceed $1 trillion this year, a historic high. While Trump seeks to pressure the Fed into rate cuts, experts caution that such actions may not significantly alleviate interest costs due to the complexity of how government debt is structured. Interest payments are now the second-largest expense in the federal budget, surpassing spending on Medicare and defense.

Key Takeaways

"You have cost the USA a fortune and continue to do so."

Trump's criticism of Powell directly blames the Fed chair for financial losses.

"Interest payments are now the second-largest spending category in the federal budget."

This quote highlights the growing significance of interest payments in federal spending.

"If your concern is the hundreds of billions of dollars we’re adding to the deficit from higher interest costs, the solution is to enact policies that are deficit reducing."

Goldwein suggests that addressing the deficit is more effective than pressuring the Fed.

Trump's public criticism of Powell highlights ongoing tensions between elected officials and the Federal Reserve. While he focuses on interest rates, the deeper issue is the growing federal deficit. Cutting interest rates may offer short-term relief, but long-term solutions require more comprehensive policies to address spending and revenue. Economists emphasize that simply pressuring the Fed will not solve the underlying problems with government debt and interest payments. This dynamic could create further complications as both political and economic stakes rise in the coming years.

Highlights

- Trump says Powell is costing the US billions by not cutting rates

- Rising interest payments threaten to overshadow other budget items

- Experts warn rate cuts may not ease interest payment burdens

- Addressing the deficit is key to reducing long-term costs

Political concerns surrounding Fed independence

Trump's comments raise risks of undermining the Fed's independence and could lead to instability in financial markets.

The debate over interest rates may intensify as the fiscal landscape evolves.

Enjoyed this? Let your friends know!

Related News

Trump aims to remove Jerome Powell from the Federal Reserve

Trump aims to remove Fed Chair Jerome Powell

Mohamed El-Erian urges Jerome Powell to resign

Trump visits Federal Reserve amid scrutiny

:max_bytes(150000):strip_icc()/GettyImages-2227723534-b867774a1c2d4a538a289a44bae02b57.jpg)

Stocks Decline as Powell Shares Outlook on Interest Rates

Powell responds to Trump administration's concerns on Fed renovation

Trump appointees influenced marble renovation costs in Federal Reserve

Trump escalates pressure on Powell amid firing threats