T4K3.news

Topshop returns to catwalk signals new direction

London Fashion Week will showcase Topshop's first catwalk in seven years as it aims to rebuild its high street presence under new ownership.

Topshop plans its first catwalk in seven years at London Fashion Week as it seeks to translate nostalgia into a durable identity under new ownership.

Topshop Returns to the Catwalk with a New Ambition

London fashion week opens with Topshop set to stage its first catwalk show in seven years, a public event that signals a broader relaunch under new ownership. The show, likely to feature campaign star Cara Delevingne, marks a return to the spotlight after the Arcadia collapse and Asos acquisition left the brand in a state of transition. Anders Holch Povlsen, who now holds a 75 percent stake, is steering a strategy that includes standalone stores and a bricks-and-mortar push, a contrast to the online-first approach many fast fashion names embrace.

Topshop’s flagship at Oxford Circus closed in 2021, but the revival plan leans on a blend of nostalgia and modern values. Executives say price points will target affordability without surrendering brand sensibilities, with jeans around £50 and dresses near £100, while supply chains are monitored under Asos’s fashion with integrity framework. The revival also leans on the brand’s history of collaborations and on its role as a social space that once defined a generation, even as it faces a crowded, ever-changing affordable fashion market.

Key Takeaways

"That’s something that we are working on all the time."

Michelle Wilson on ongoing strategy development for Topshop under Asos

"It was like an immersive amusement park for the teenage girl."

Olivia Allen on the store’s cultural impact

"We had a shared vision. What we wanted to do was to completely exceed and blow away our customers’ expectations."

Jane Shepherdson on Topshop’s early success mindset

"going down the escalators and potentially losing hours in there"

Laura Antonia Jordan on the store’s nostalgic pull

Nostalgia can spark demand, but it does not guarantee ongoing relevance. Topshop now faces the task of defining a clear identity beyond the memory of its peak years, balancing mass appeal with a sense of exclusivity. The push for bricks-and-mortar is a bold bet on a brand experience, yet without a cohesive product range and authentic values, the store risks becoming a relic rather than a rallying point for a new generation.

The retailer must reconcile two pressures: deliver value that resonates with today’s shoppers and maintain the brand’s credibility in a market crowded with low-cost options. If the relaunch leans too heavily on price alone, it could erode perceived quality. If it leans toward exclusivity without broad accessibility, it may struggle to rekindle the broad consumer base that once defined its success. A well-executed flagship could help, but only if it translates online and offline into a consistent catalog, compelling storytelling, and responsible sourcing.

Highlights

- Nostalgia is a doorway not a blueprint

- Topshop must wear a new voice as well as a memory

- Price should reflect values not just trend

- A flagship is a test of whether the brand can move tomorrow

Topshop revival faces budget and public reaction risks

The comeback hinges on balancing affordable pricing with perceived value while managing investor expectations and public reaction. If the strategy relies too heavily on nostalgia without delivering durable product quality and a clear contemporary identity, it risks eroding brand equity among young shoppers and attracting skepticism from investors.

The comeback will be judged less on history and more on whether Topshop can craft a future that people trust and want to wear.

Enjoyed this? Let your friends know!

Related News

Buffy returns in Sunnydale revival

Mia Sara returns to cinema after poetry phase

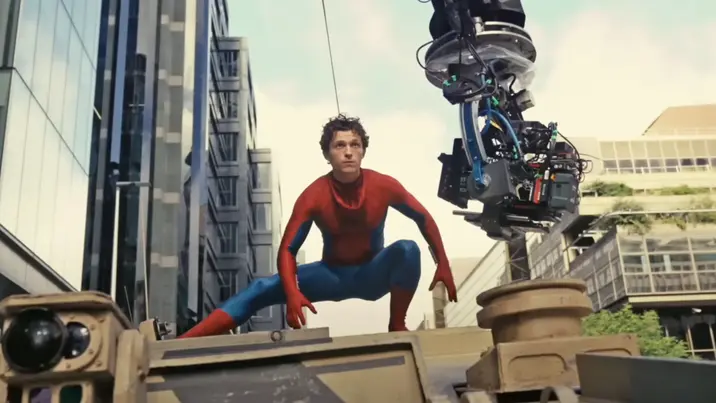

Spider-Man Brand New Day begins filming in Glasgow

Shrek 5 delayed to June 2027

Eight New Horror Films Hit Screens Across Theaters And VOD

Freaky Friday expands into a new Freakyverse

Fisher eyes return to college coaching

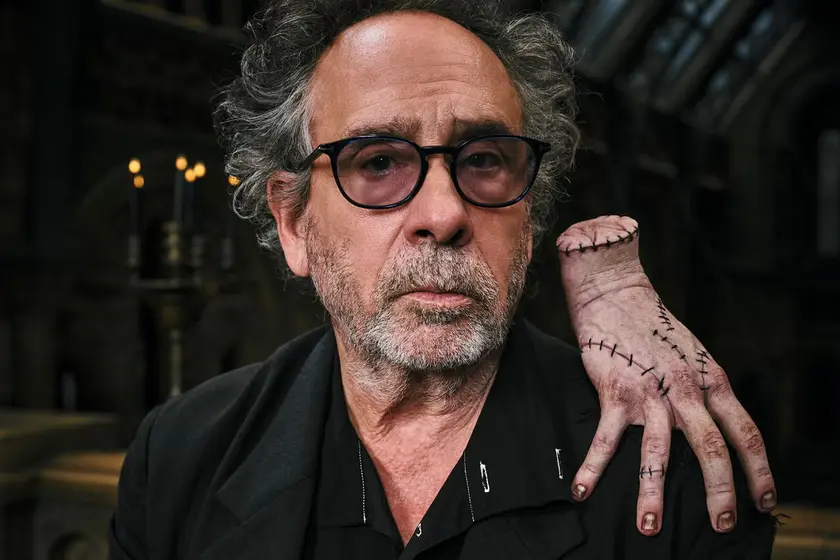

Wednesday season two update