T4K3.news

Taylor Swift Tax expands to More States

Rhode Island targets luxury second homes with a new levy, prompting debate over revenue and the impact on seasonal residents.

Rhode Island’s luxury home levy, nicknamed the Taylor Swift Tax, expands to second homes and ignites a debate over revenue and local economies.

Taylor Swift Tax Expands to More States

Rhode Island’s new surcharge applies to non primary residences valued above $1 million. It charges $2.50 for every $500 of assessed value above that threshold, on top of existing property taxes. Swift's Watch Hill home, valued around $28 million, would see an estimated $136,000 increase, bringing her yearly bill to about $337,000. The measure is part of a broader push by states to tap luxury real estate to help cover budget gaps amid shifting federal policy.

Brokers and longtime residents say the tax targets the very buyers who keep local shops and hotels busy during the summer. Critics warn it could drive wealthier buyers to nearby states or discourage new purchases, at least in the near term. Some buyers are pausing while others consider alternatives in neighboring coastal towns.

Key Takeaways

"These are people who just come here for the summer, spend their money and pay their fair share of taxes."

A Rhode Island broker defending the impact of seasonal residents.

"You're chasing away the people who spend most of the money in these towns."

Local business leader warning about economic impact.

"It's always about choices."

Broker explaining how buyers weigh tax costs against lifestyle.

The move reflects a broader political moment where states lean on visible symbols of wealth to close budget gaps. By naming the Rhode Island plan after a celebrity, supporters tap into a narrative that high earners should contribute, even if they live elsewhere most of the year. Critics argue the policy could backfire if it reduces local spending that supports jobs and services.

The risk is that luxury taxes become a stopgap rather than a structural solution. If revenue falls short or costs rise, more towns may chase the next big taxpayer instead of addressing core issues like affordable housing for locals. The debate shows how policy can collide with local identity and regional economics.

Highlights

- They are getting penalized just because they also live somewhere else

- You're chasing away the people who spend most of the money in these towns

- It's always about choices

- Coastal towns depend on summer money to stay afloat

Backlash risk over luxury tax measures

The Rhode Island levy and related measures could trigger political backlash and affect local economies that rely on seasonal spending; success depends on how revenue materializes.

The real test is whether revenue gains can justify potential disruption to seasonal economies and local character.

Enjoyed this? Let your friends know!

Related News

Rhode Island raises second home tax

Taylor Swift drops new album date and track list

Americans move from big cities for space and cheaper living

Universal Music Group Files for U.S. Public Offering

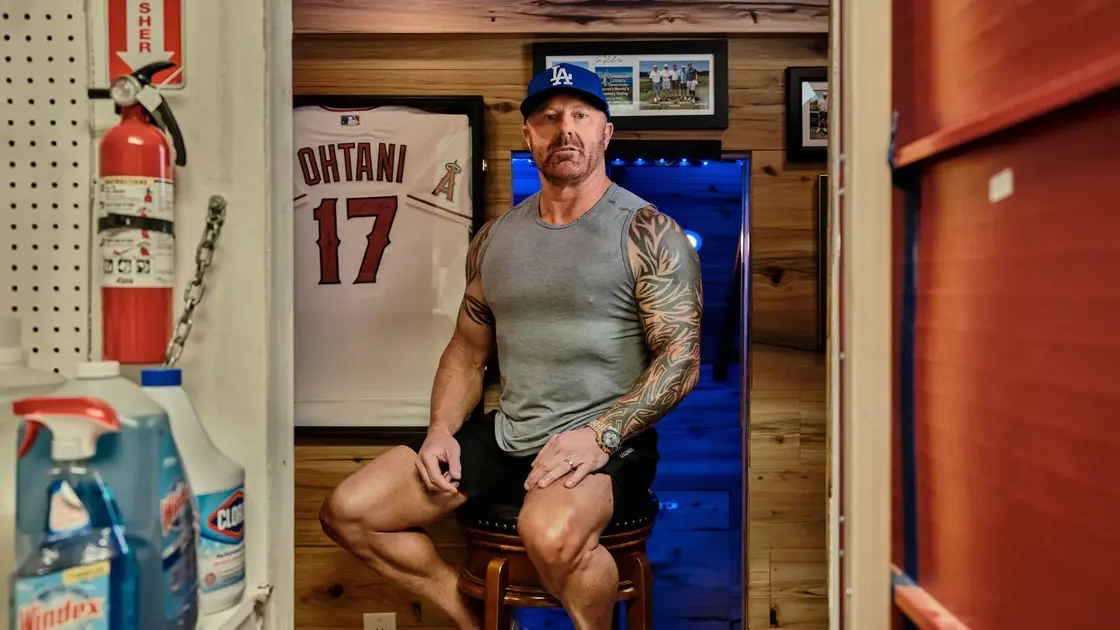

Bookie tied to Ohtani case ready to talk

Germany charges Syrian juvenile in concert terror plot

Taylor Swift fuels Kelce podcast growth

Swift episode sets new marks in cross platform influence