T4K3.news

S&P 500 Achieves Record High Following Trade Deal Announcement

The S&P 500 has reached a new high as investors react positively to a U.S.-Japan trade agreement.

Stocks rose sharply as optimism grew from a new U.S.-Japan trade agreement.

S&P 500 Reaches Record High on U.S.-Japan Trade Deal

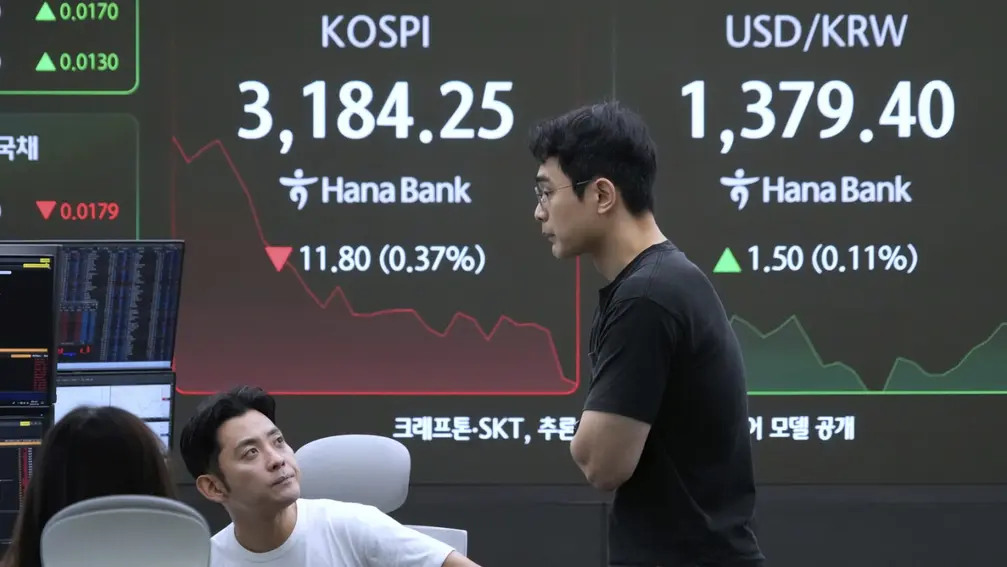

Stocks were solidly higher in midday trading Wednesday, boosted by news of a U.S.-Japan trade deal. The S&P 500 climbed to an all-time high, increasing by 0.5%. The Dow Jones Industrial Average also rose by 0.9%, nearing its first new high since December. In addition, the Nasdaq Composite added 0.3%. Investors were optimistic following President Donald Trump's announcement that the new trade deal would impose a 15% tariff on imports from Japan, a significant reduction from the previously proposed 25%. This positive sentiment came ahead of upcoming earnings reports from major tech companies. Shares of Toyota and Honda surged by approximately 13%, reflecting the deal's favorable impact on Japanese automakers. However, companies like Texas Instruments and Fiserv saw declines after disappointing earnings results.

Key Takeaways

"The S&P 500 climbed to an all-time high, increasing by 0.5%."

This highlights the positive investor response to the new trade deal.

"The uplift in stocks demonstrates how sensitive the market is to geopolitical events."

This reflects the delicate balance investors must navigate between optimism and caution.

The uplift in stocks demonstrates how sensitive the market is to geopolitical events, especially trade deals that can shift economic forecasts. Analysts remain cautious, acknowledging that while lower tariffs may help corporate profitability short-term, concerns about inflation and economic growth linger. Anticipation builds as key technology companies prepare to reveal their earnings, which could set the tone for the broader market. The mixed results from various sectors, alongside the performance of the dollar and commodities, reflect a complex economic landscape where investors are weighing optimism against potential challenges.

Highlights

- U.S.-Japan trade deal boosts stocks, but inflation concerns linger.

- Trade agreements significantly shape market sentiment.

- Tech earnings could dictate the next market movement.

- Investors celebrate, but caution remains in the air.

Market risks associated with trade uncertainties

The positive market reaction comes amid overarching concerns about inflation and economic growth, especially given ambiguous trade relations.

Investors are closely watching how the upcoming earnings reports will influence market trends.

Enjoyed this? Let your friends know!

Related News

S&P 500 and Nasdaq Close at Record Highs

Markets Rally on CPI Beat Spurs Fed Rate Cut Bets

U.S.-EU trade agreement announced amidst busy market week

Supermicro and Nike stocks rise while Albemarle falls

FTSE 100 reaches intraday high of 9,102.53

Global markets surge after US-EU trade agreement

Stock market rises despite global uncertainties

Tech stocks retreat as markets pause after record highs