T4K3.news

Robinhood to purchase WonderFi for $180 million

On Tuesday, Robinhood confirmed its plan to acquire Canadian crypto firm WonderFi.

Robinhood aims to strengthen its position in the growing crypto market with this acquisition.

Robinhood acquires Canadian crypto firm WonderFi for $180 million

Robinhood announced on Tuesday its acquisition of Canadian crypto firm WonderFi for C$250 million ($178.98 million). This all-cash deal values WonderFi at a premium of 41% per share compared to its previous close. The move reflects Robinhood's strategy to expand internationally and dive deeper into the crypto sector, moving beyond its origins as a stock-trading platform. WonderFi operates popular exchanges like Bitbuy and Coinsquare and saw a significant increase in trading volumes last fiscal year. With this acquisition, Robinhood plans to integrate WonderFi's workforce into its existing Canadian operations, which already includes over 140 employees.

Key Takeaways

"WonderFi's focus on beginner and advanced users makes it an ideal partner."

Robinson's Senior VP highlighted the strategic fit of integrating WonderFi into their operations.

"We are excited to integrate WonderFi's innovative services into our platform."

The CEO of Robinhood expressed enthusiasm about the acquisition's potential.

The acquisition of WonderFi signals Robinhood's commitment to the crypto market as it seeks to appeal to both novice and experienced crypto users. This move is part of a broader trend within the industry, with major players like Coinbase and Ripple also making significant investments. The surge in interest in cryptocurrencies, evidenced by rising bitcoin prices, could offer Robinhood a pathway for future growth, especially as traditional markets show volatility. However, the overall impact of these acquisitions on Robinhood's long-term strategy remains to be seen.

Highlights

- Robinhood is making waves in crypto with its latest acquisition.

- WonderFi's strength in crypto makes it a perfect match for Robinhood.

- This deal could shape the future of Robinhood's crypto strategy.

- The crypto sector is booming, and Robinhood is diving in.

Potential risks linked to Robinhood's acquisition strategy

Robinhood's aggressive expansion into crypto, while promising for growth, may attract scrutiny from regulators and impact its existing stock trading model. The volatile nature of the crypto market adds uncertainty to its long-term strategy.

The future for Robinhood in crypto looks promising, but challenges remain.

Enjoyed this? Let your friends know!

Related News

EuroMillions jackpot of £145 million remains unclaimed

Thunderbolts now available for rent or purchase

Stellar's Price Set for Rise After Trump's Crypto Bill

Robinhood exceeds earnings expectations

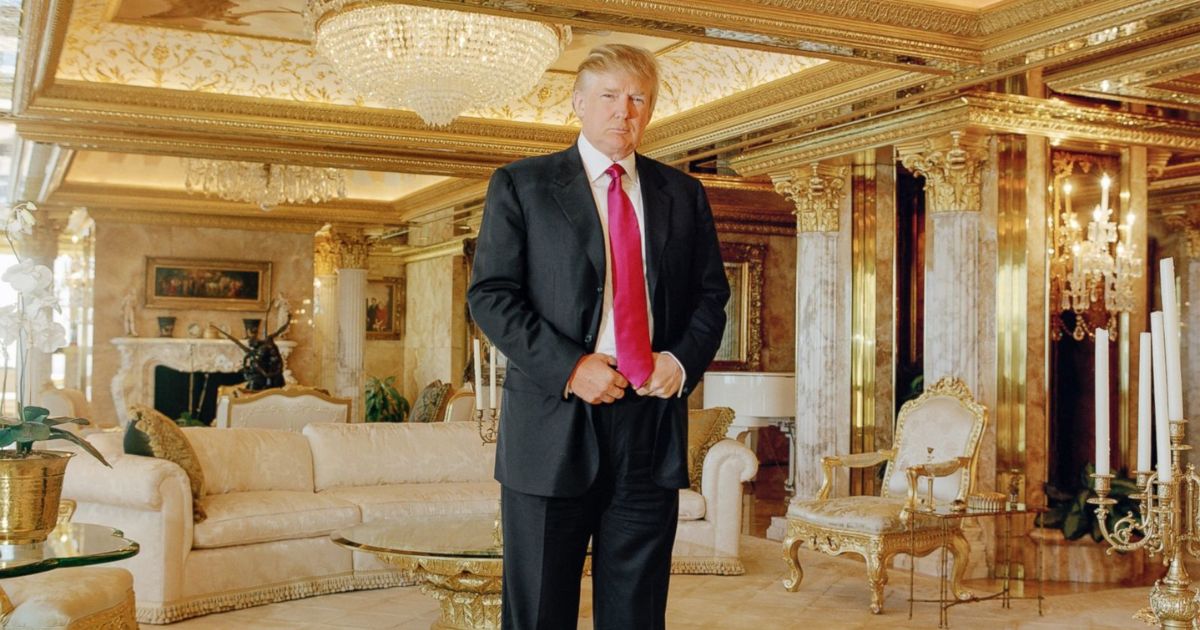

Donald Trump invests millions in luxury lifestyle

Microsoft shuts down Movies and TV store on Xbox

Tom Brady reacts to Jake Paul's $42 million investment

Los Angeles luxury real estate sales lead with Hilton's $63 million purchase