T4K3.news

Potential payouts confirmed for car finance consumers

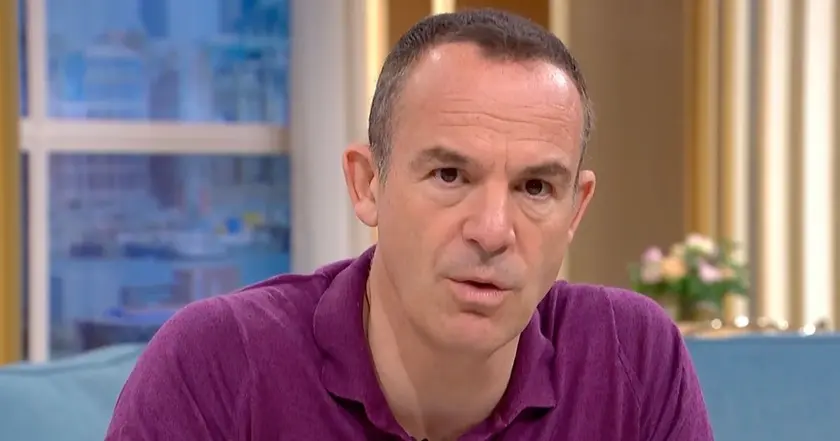

Martin Lewis states millions may still receive compensation following a Supreme Court ruling.

Martin Lewis indicates millions may still receive compensation after a Supreme Court ruling.

Martin Lewis highlights ongoing car finance compensation opportunities

Millions of motorists in the UK may still be eligible for compensation following a recent ruling by the Supreme Court. The court judged that two key cases did not violate the law regarding commission payments from lenders to car dealers. Even so, Martin Lewis has stated that many consumers might receive payments as part of a broader compensation scheme now set in motion by regulators. The landmark ruling involved appeals concerning commission payments made without consumers' informed consent when they purchased cars on credit. While the ruling favored the finance firms, it also affirmed that some consumers can pursue claims under the Consumer Credit Act. The Financial Conduct Authority has indicated that payouts might range from £9 billion to £18 billion, potentially giving eligible consumers up to £950 each. However, claims will not be guaranteed, and the details of the compensation process are still being finalized.

Key Takeaways

"Millions of people are still likely to be due payments."

Martin Lewis emphasizes the ongoing eligibility for compensation among motorists.

"It looks unlikely to be a repeat of the PPI scandal."

Investment director Russ Mould reassures that damages will not be as severe as previous crises.

The ruling has prompted mixed reactions, particularly from financial institutions that may face compensation claims from consumers. The motor finance industry has responded with renewed optimism as the ruling was not as detrimental as anticipated. Despite this positive outlook, the significant potential for payouts creates tension. Martin Lewis's prediction that as many as 40% of those who took out car loans from 2007 to 2021 may be owed compensation amplifies the stakes in this already sensitive sector. The ongoing uncertainty regarding claims and the exact nature of payouts could lead to confusion among consumers and financial entities alike.

Highlights

- Millions of motorists could still see compensation checks soon.

- Don't overlook that you might be owed money for car loans.

- Forty percent of car finance deals could lead to payouts.

- The industry braces for potential payouts in the billions.

Potential compensation backlash

The compensation scheme may create significant financial implications for the motor finance industry, potentially leading to regulatory scrutiny and public debates.

As the financial landscape evolves, vigilance on consumer rights remains crucial.

Enjoyed this? Let your friends know!

Related News

Supreme court to announce ruling on car finance scandal

Car finance redress scheme update

UK supreme court to rule on hidden commissions in car finance

Ruling limits car finance payouts for lenders

UK Supreme Court rules on car finance scandal

Rachel Reeves considers intervention in car finance ruling

Supreme Court rules against car finance motorists

UK lenders see shares jump after court ruling