T4K3.news

Pension fraud probe charges six defendants linked to Store First

A Serious Fraud Office investigation has charged six defendants over a £75m pension fraud tied to Store First, with appearances set at Westminster Magistrates' Court

Six defendants including a Mann Island director are charged in a £75m pension fraud probe tied to Store First

Pension fraud probe charges six defendants linked to Store First

Six defendants have been charged by the Serious Fraud Office in connection with a £75m pension scheme linked to the storage company Store First. The investigations cover movements of funds from self invested personal pensions into storage units mainly in the north of England and Scotland between 2011 and 2014. Prosecutors say investors were promised a guaranteed return and units ready to rent, with marketing incentives that may have concealed tax liabilities for withdrawals.

Toby Whittaker, 48, listed as a director of Store First Limited now known as Store First Newco Limited, faces conspiracy to defraud charges. Others named include Stephen Michael Talbot and Stuart Grehan, who face additional counts such as money laundering and Perjury Act offences. A sixth defendant is unnamed. Whittaker is also listed as a director of Group First Limited, the parent company behind Store First, which operates a portfolio extending beyond self storage to other property ventures. Mann Island Premier Apartments Limited sits within Group First’s holdings in Liverpool, alongside projects in Manchester, Salford and Nelson. The defendants are due to appear at Westminster Magistrates’ Court.

Key Takeaways

"Trust is the currency of retirement and it cannot be gambled away"

a call for safeguarding savers

"If a deal sounds too good, it probably is"

a warning to investors

"Protect savers before profits"

a principle for pension safeguards

"Justice will follow the facts as this case unfolds"

a reminder of due process

The case highlights how savers can be exposed to opaque pension products marketed with promises of high returns. It raises questions about how such schemes are sold and monitored, and about the protection available to ordinary investors who trusted financial advisers and marketing materials. If proven, the charges could prompt stricter oversight of self invested pensions and related property investments, and a hard look at how fiduciary duties are enforced in complex financial networks.

Overall, the SFO action signals a tougher approach to pension related fraud and a push to close gaps that critics say have allowed some schemes to mislead investors for years. The outcome will influence future rules, the behavior of promoters, and the level of scrutiny applied to niche investment products tied to real estate.

Highlights

- Trust is the currency of retirement and it cannot be gambled away

- If a deal sounds too good, it probably is

- Protect savers before profits

- Justice will follow the facts as this case unfolds

Pension fraud investigation flags financial risk for investors

The charges involve complex pension transfers and marketing claims that may have misled savers. The case underscores the need for clear warnings and stronger oversight of niche investment products tied to real estate.

The outcome will shape how pension deals are sold and supervised in the years ahead.

Enjoyed this? Let your friends know!

Related News

Merseyside jails 66 criminals in July

Bolton FBI raid tests line

Texas election probe moves forward

Former first lady Kim Keon Hee jailed

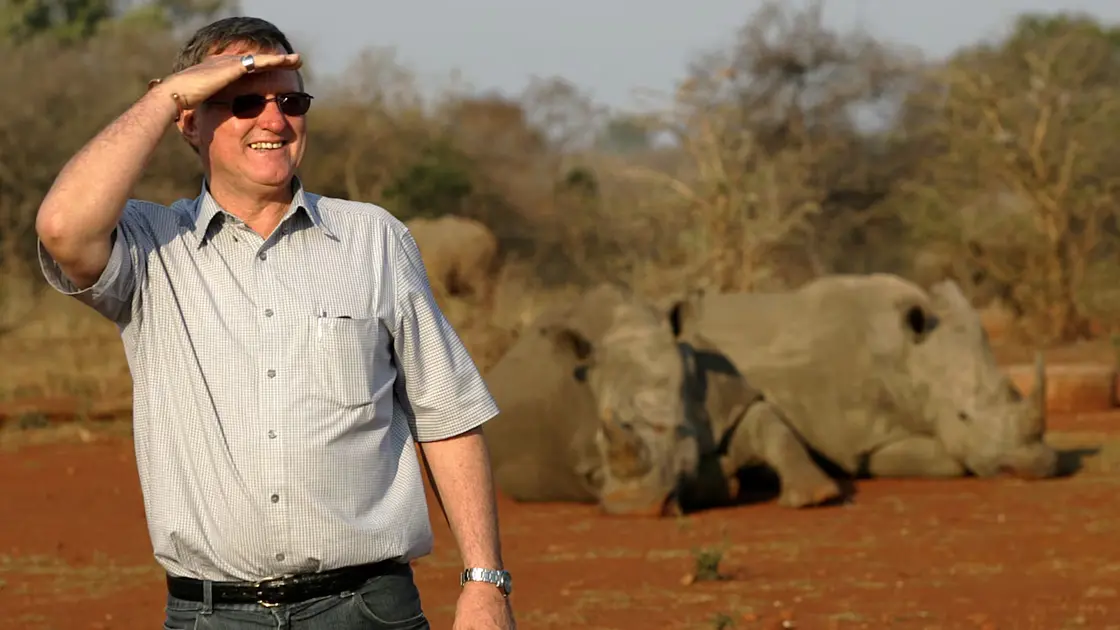

Rhino horn trafficking ring busted in SA

UK economy grows as PMI rises WH Smith slides on accounting error

Kohli to stand trial on sex offence charges

SLC45A4 and pain link discovered