T4K3.news

Palantir growth outlook under review

Palantir reports strong Q2 results with high bookings; valuation remains a concern for investors.

Palantir reports strong Q2 results with high growth and rising bookings, while investors weigh valuation against upside.

Palantir Growth Targets and Valuation Debate

Palantir posted a strong Q2 with 48% revenue growth year over year, record bookings, and rising gross margins. The company also signaled ambitious growth targets for the years ahead, including a finish near 50% growth in 2025 and about 42% year over year in the following period. Despite the positive momentum, investors remained mindful of Palantir's rich valuation and whether the growth trajectory can sustain multiple expansion.

The business mix, including a sizable share of government contracts and a growing commercial footprint, helps explain the durable demand narrative. Still, the valuation questions persist because upside hinges on sustained execution, margin expansion, and the ability to translate new bookings into steady cash generation. In this environment, the market will reward clear proof of durable growth rather than headlines alone.

Key Takeaways

"growth outpaces doubt when margins rise"

highlights the link between margin expansion and a stronger growth story

"valuation remains the soft spot for the bulls"

captures investor concern about price versus perceived upside

"record bookings raise the bar for the next quarters"

notes the momentum implied by the latest bookings data

"investors will want real cash flow not promises"

emphasizes the market's focus on durable profitability

The quarterly results show Palantir moving from a services-led to a software-driven model, with bookings signaling strong demand momentum. Margins rising alongside growth suggests pricing power and operating leverage, but the real test is whether this can be maintained as the company scales. A slower ramp in commercial revenue or higher customer concentration risk could complicate the story.

Investors should watch for how Palantir manages profitability alongside growth. If free cash flow improves and revenue diversification deepens, the stock may justify a higher multiple. If not, the high starting point could invite greater volatility and quicker sentiment shifts when quarterly numbers miss expectations.

Highlights

- growth outpaces doubt when margins rise

- valuation remains the soft spot for the bulls

- record bookings raise the bar for the next quarters

- investors will want real cash flow not promises

Valuation and growth risk for Palantir investors

Palantir faces a valuation-sensitive setup even as it prints strong growth and bookings. If growth slows or margins stall, the stock could face multiple compression. The mix of government revenue exposure and long sales cycles introduces policy and budget risk that could amplify volatility.

The market will decide if Palantir can turn momentum into lasting value

Enjoyed this? Let your friends know!

Related News

Stock Market Suffers Drop After Weak Jobs Report

Piper Sandler Rates Palantir Stock Overweight With $170 Target

Rick Orford Gives Strong Buy Rating on Palantir Stock

Palantir reports record revenue amid AI integration

Palantir Stock Hits Record High

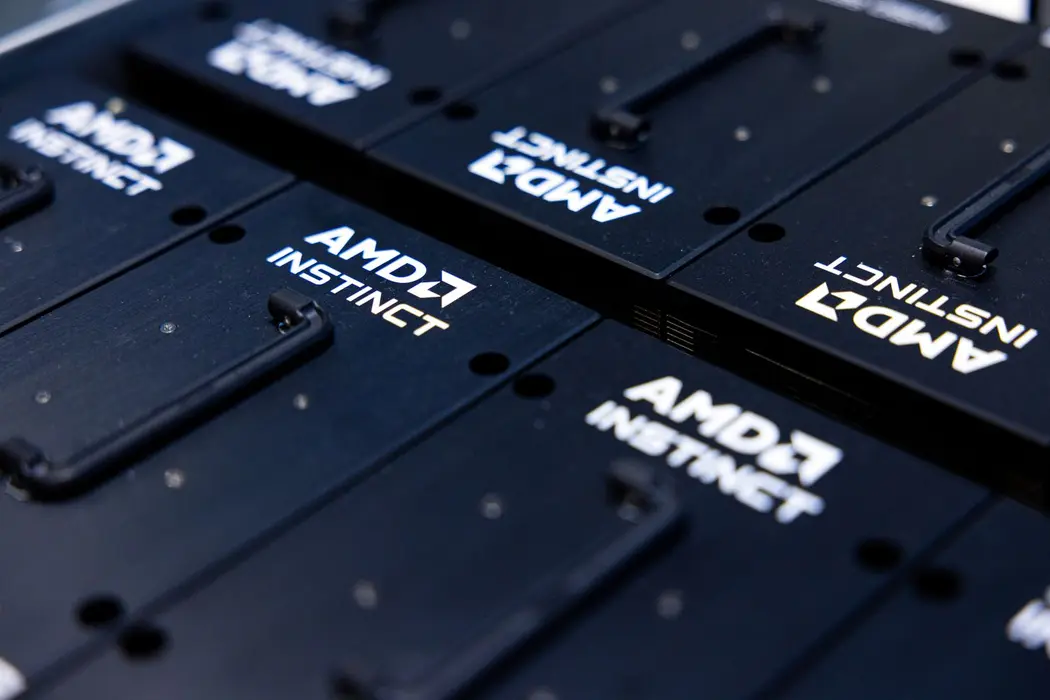

AMD stock declines despite strong quarterly results

Tesla's UK sales drop nearly 60 percent

Archer stock outlook improves on Launch Edition and defense bets