T4K3.news

Palantir faces dilution risk warning

A top investor warns that Palantir’s high valuation may hinge on dilution and ambitious growth.

A top investor warns that Palantir’s valuation may be inflated by dilution even as the company delivers growth.

Palantir Stock Faces Scrutiny Over Dilution and High Valuation

Palantir diluted about 148 million shares in the past year, lifting the diluted share count to 2.56 billion and adding roughly $28 billion in market value while the company is forecast to generate about $4.15 billion in revenue this year. This created a gap between the stock’s price and the underlying earnings power that some investors say may be unsustainable.

In a caveat that drew attention from market watchers, Stone Fox Capital argues that Palantir trades at more than 100 times sales, a level they describe as dangerously optimistic given the trajectory of revenue growth. The firm notes Palantir posted 48% revenue growth in the latest quarter to just over $1 billion, with U.S. commercial sales up 93% but totaling only $306 million for the quarter. While the stock has risen about 1,870% over five years, revenue grew 244% in the same period, suggesting the market may be pricing future gains more aggressively than current results justify. Wall Street remains cautiously positioned, with a neutral Hold consensus and a target near $155, implying potential downside in the year ahead.

Key Takeaways

"At over 100x sales, Palantir’s stock price reflects excessive optimism, making it a dangerous bet for investors despite strong recent results."

Stone Fox Capital’s warning on valuation.

"Palantir could still climb toward $200 a share, potentially pushing its market cap near $1 trillion."

SFC outlines upside scenario.

"The downside risk only grows with any gains from here."

SFC final takeaway on risk.

"About 148 million shares were added, lifting the diluted share count to 2.56 billion."

Dilution detail from the article.

This story highlights a widening tension between hype around AI driven growth and the hard math of business economics. Dilution can dilute value just as much as it expands it, especially if a company relies on stock-based incentives to attract talent. Palantir’s path to scale could be slower than investors expect, lowering per-share growth even if headline revenues rise. The market’s willingness to pay for future optionality matters, but so does governance that aligns management incentives with long-term returns for shareholders.

Highlights

- Bullish charts can hide sharp cliffs ahead

- Growth looks fast until reality checks arrive

- Dilution can lift value while masking real costs

- High valuation without profits invites a painful correction

Investors face high risk from Palantir dilution driven value

The stock has drawn attention for large share dilution that added roughly $28 billion in market value while revenue forecasts sit at about $4.15 billion this year. The valuation, cited by a prominent investor, signals substantial downside risk if growth slows or dilution pressures persist.

The Palantir narrative is still trying to balance hype with fundamentals.

Enjoyed this? Let your friends know!

Related News

Tech stocks retreat as markets pause after record highs

HSBC CEO warns against tax increases

Top Investor Highlights Risks for Palantir Technologies

Acid attacks surge in Northumbria region prompting policy response

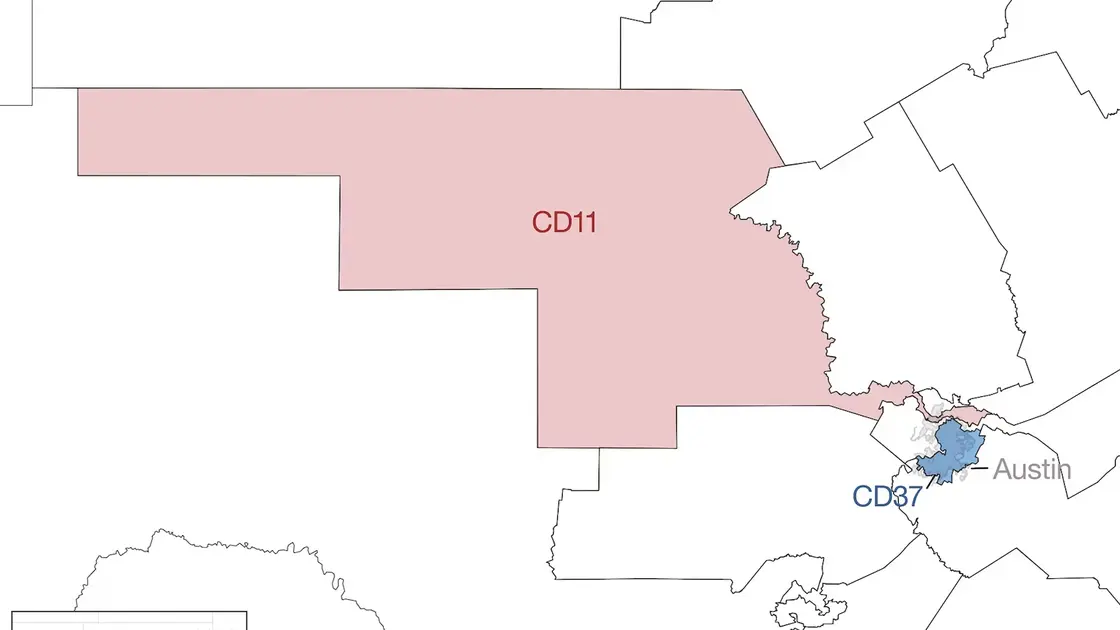

Texas redistricting moves Austin voters into distant rural districts

EU budget plan risks biodiversity funding

DVLA warns drivers about risks of specific medications

Greece initiated weather alerts for high temperatures