T4K3.news

OpenAI faces a reality check on AGI funding

OpenAI warns money could change in a post-AGI world while SoftBank leads a new round valuing the company at $300 billion.

A critical look at how warnings about money in a post AGI era clash with fresh AI funding and a frothy market.

OpenAI Faces Reality Check as AGI Raises Fresh Funding Amid Doubts

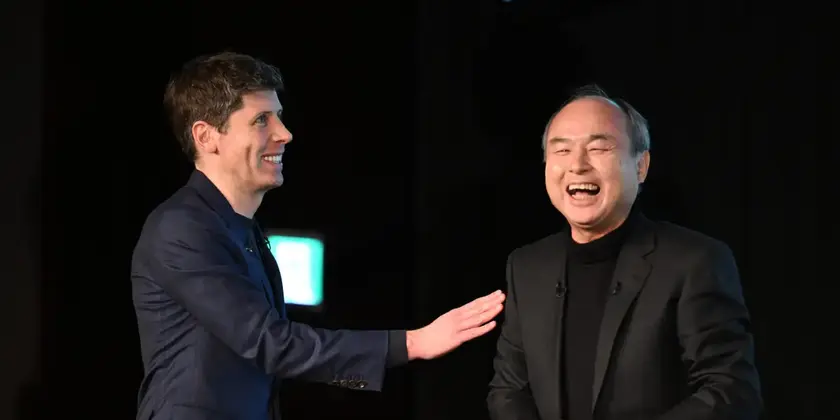

OpenAI chief executive Sam Altman has warned that money could lose its meaning in a world with true AGI, even as SoftBank and other backers push for a fresh round that values OpenAI around $300 billion. At the same time, insiders continue to cash out, with current and former employees selling about $6 billion of stock, highlighting a split between buoyant investor sentiment and uneasy market signals. The broader AI funding scene is under scrutiny as SPACs and SPVs help fuel high hopes, while UBS cites an MIT study showing 95 percent of firms report no measurable returns from AI investments to date.

Inside many workplaces, the push to deploy AI remains strong. Microsoft has told staff that using AI is not optional, and some Amazon units tie AI use to promotion, signaling a shift from experimentation to performance pressure. Publicly, OpenAI has acknowledged the uncertainty surrounding money in a post-AGI future, even as the company continues to raise traditional funding rounds. The tension between hype and reality grows as investor skepticism surfaces and growth ambitions collide with practical ROI concerns.

Key Takeaways

"Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes."

Altman’s public take on investor sentiment toward AI.

"The models have already saturated the chat use case. They're not going to get much better... And maybe they're going to get worse."

Altman on model improvements after GPT-5.

"The smartest people at OpenAI are taking $6B off the table. That should tell you everything."

Elena Gold commenting on insider stock sales.

"It may be difficult to know what role money will play in a post-AGI world."

OpenAI’s note to investors about a post-AGI economy.

The piece highlights a tension at the heart of modern tech hype: the ability to fund ambitious dreams while grappling with uncertain returns. When leaders warn that money could be irrelevant after AGI, yet continue to attract billions in capital, it exposes a fragile confidence game among investors and founders. This gap can fuel volatile markets if expectations diverge from real-world productivity gains. The dynamic also raises questions about governance, worker impact, and how startups balance long-term risks with near-term incentives. As AI becomes a force in daily work, the stakes are not just tech bets but social and policy choices about value, control, and accountability.

Highlights

- AGI could redefine what counts as wealth

- Investors are overexcited about AI

- Money may lose meaning in a post AGI world

- The smartest people at OpenAI are taking 6B off the table

Financial and political risk around AI funding

The article ties together high-stakes funding rounds, insider stock sales, and forward-looking warnings about money in a post-AGI world. This mix raises concerns about market froth, investor backlash, and potential policy scrutiny as copies of risk accumulate.

The AI economy is at a crossroads where ambition meets reality, and the next moves will shape both markets and workers.

Enjoyed this? Let your friends know!

Related News

AI risk shaping money and life

AI hype cools as investors reassess the bubble

Alexandr Wang appointed Chief AI Officer at Meta

AI investment cautious as hype cools

Germany plans face execution risk

Keach Hagey highlights Altman's journey in new biography

OpenAI maps a broader future after GPT-5

Social Security Payments May Be Garnished