T4K3.news

Nygren hunts hidden gems in an expensive market

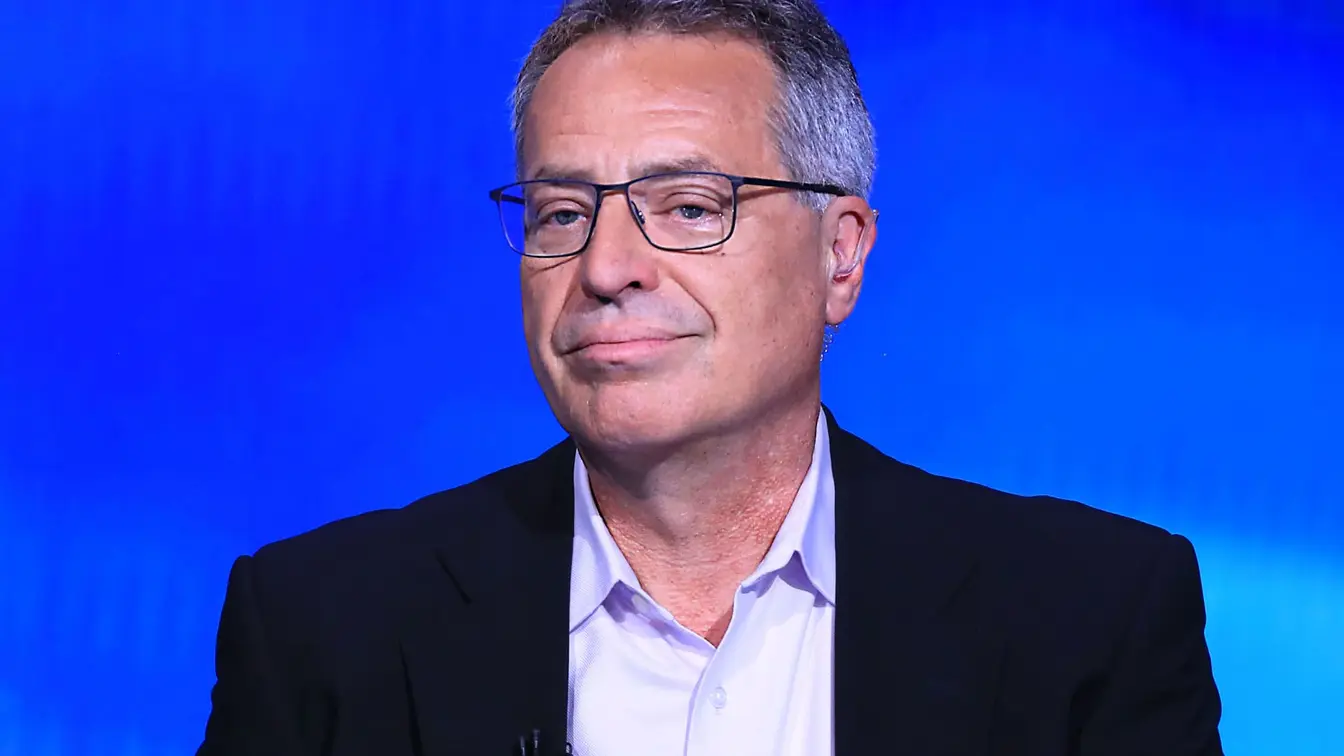

Oakmark’s Bill Nygren focuses on cheap stocks with strong capital returns in a market at record highs.

Nygren targets cheap stocks with strong capital return programs in a market near record highs.

Nygren Hunts Hidden Gems in an Expensive Market

Bill Nygren, a veteran portfolio manager at Oakmark Funds, says he hunts inexpensive stocks that still return capital to shareholders. With the S&P 500 trading around 23 times forward earnings, Nygren notes that almost half of his holdings have multiples below 12x. He argues that although organic growth may be limited, these firms generate free cash flow that supports buybacks and dividends. "These companies don't have great organic growth opportunities, but they're generating a lot of free cash flow that doesn't need to be reinvested in the business and they do buybacks and dividends because of that," Nygren said on CNBC's Squawk Box.

Key Takeaways

"These companies lack strong organic growth but generate a lot of free cash flow."

Nygren on why buybacks matter for cash returns

"What the market doesn't pay for is the growth from share repurchases."

Nygren on market mispricing

"It's becoming very interesting, the business is almost entirely internet and mobile today."

Nygren on Charter Communications valuation

"You're getting paid a lot to take on that risk at five times earnings."

Nygren on GM valuation

Nygren’s approach reflects a traditional value tilt in a market where prices sit at or near record highs. If free cash flow remains robust and buybacks continue, cheap names can compound value even without strong growth. The strategy hinges on discipline in capital allocation and the ongoing willingness of companies to return cash to shareholders. It also depends on macro stability, including tariffs and broader economic momentum, to avoid a sudden rerating of earnings.

Highlights

- Cheap stocks with big buybacks beat rising price tags

- Free cash flow is king for shareholders in a high market

- Market pricing misses growth from share repurchases

- Value ideas persist when growth stalls

Financial and market risk in value bets

Nygren’s strategy relies on continued cash returns and favorable market conditions. If buybacks slow, tariffs bite profits, or multiples stay high without earnings growth, the approach could underperform.

The next market cycle will test whether this cash return driven approach can endure.

Enjoyed this? Let your friends know!

Related News

High parking fees threaten family outings

Woman finds valuable Harry Potter cards at charity shop

VW Golf R Estate faces diminishing market appeal

Zillow and Compass conflict may disrupt real estate listings

Leominster's independent shops thrive despite challenges

Budget-Friendly Ranch Steak Grows Popular

Saltcoats named UK's cheapest seaside town

Las Vegas experiences decline in international tourist numbers