T4K3.news

Monzo expands into mobile services

Monzo is exploring a UK mobile service using a digital SIM card to diversify revenue and enhance customer experience.

Monzo weighs launching a digital SIM card and its own mobile contracts in the UK to broaden revenue and sharpen competition with legacy networks.

Monzo plans UK mobile service to diversify revenues

Monzo is exploring a digital SIM card and the idea of offering its own mobile service in the UK. The fintech says it is in the early stages of developing this concept and wants to apply the Monzo way to a mobile contract product. If successful it could add another revenue stream and put pressure on incumbents such as Vodafone, Three and EE. The move follows Monzo growth to more than 13 million UK customers and a staff base above 3,900, with an eye on a future IPO. The company has secured a banking licence and has attracted strong investor interest, even as it faces regulatory headwinds. The Financial Times reported the plan, and Monzo has faced a £21m fine from the FCA over weak financial crime controls which the company says is now resolved. The FCA findings highlighted that customers could register with implausible addresses including 10 Downing Street and Buckingham Palace. Chief executive TS Anil said the fine marks the past and that changes have been made to governance and controls.

Key Takeaways

"Monzo is known for transforming products and an entire industry to deliver a great experience for customers"

Monzo spokesperson statement about customer focus

"An investigation by the Financial Conduct Authority found that the controls were lax enough that customers were able to register for accounts using obviously implausible UK addresses when applying for an account"

FCA findings cited in relation to Monzo

"firmly in the past with our learnings at the time leading to substantial improvements in our controls"

Chief executive TS Anil on regulatory issues

This move tests whether a bank can successfully operate in a sector that relies on spectrum and network agreements. If Monzo can strike favorable terms with networks and deliver simple pricing it could force the big operators to rethink bundles and fees. The bigger risk is trust after the FCA fine and the scale of regulatory scrutiny fintechs now face as they expand into new lines of business. Investors will weigh growth against governance and the ability to manage cross sector operations without duplication of risk.

Highlights

- Monzo bets on a mobile future beyond cards

- A bank aiming to run a network could reset the market

- Growth hinges on trust after the FCA fine

- The idea tests if fintechs can cross from app to operator

Regulatory and financial risk

Monzo plans a mobile service amid a recent FCA fine for weak financial crime controls, raising questions about governance and investor confidence

The next year will show whether Monzo can turn app strength into a lasting platform

Enjoyed this? Let your friends know!

Related News

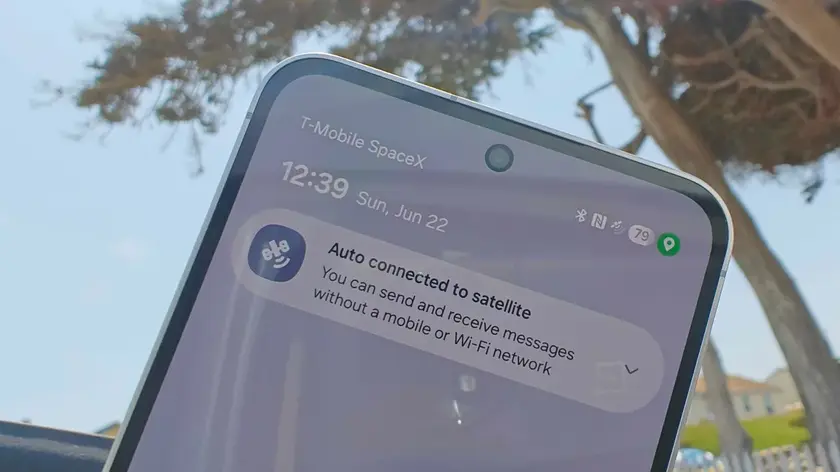

T-Mobile Launches T-Satellite Service Today

Samsung plans to increase Now Bar app support

Samsung confirms launch of Galaxy Z TriFold and Android XR headset

Waymo launches robotaxi service in Dallas

NatWest announces closure of 54 branches

Monzo leads UK banks in customer service rankings

Joby Aviation announces acquisition of Blade Air Mobility

Pixel 10 Pro announced