T4K3.news

JPMorgan Chase to explore stablecoins

Jamie Dimon announces the bank's plan to engage with stablecoins amid fintech competition.

JPMorgan Chase is exploring stablecoins to keep up with fintech competition.

JPMorgan Chase confirms plans for stablecoins

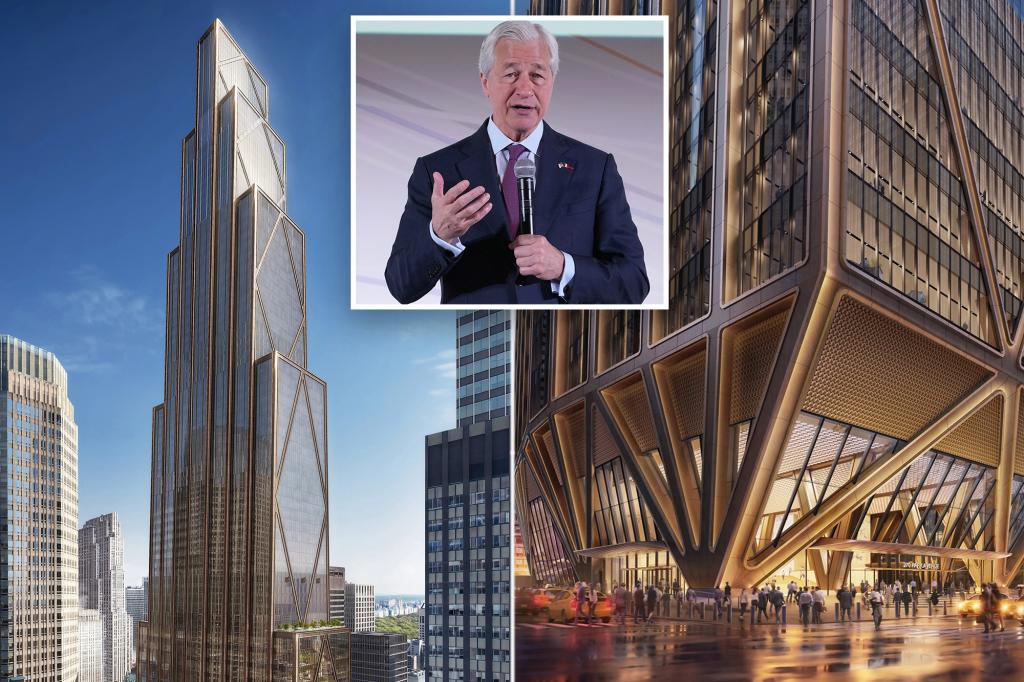

JPMorgan Chase's CEO Jamie Dimon stated in a recent earnings conference call that the bank plans to engage with stablecoins despite his skepticism about their value. The bank has announced a new stablecoin, designed exclusively for its clients. Dimon highlighted the importance of understanding the technology to compete with fintech companies that aim to penetrate the financial sector. He expressed that while stablecoins are legitimate, he questions their necessity over traditional payment methods. JPMorgan, a leader in moving nearly $10 trillion daily, is responding to an evolving regulatory environment that supports digital currencies.

Key Takeaways

"We're going to be involved in both JPMorgan deposit coin and stablecoins to understand it, to be good at it."

This quote reflects JPMorgan's commitment to explore stablecoins despite Dimon's skepticism.

"You know, these guys are very smart."

Dimon acknowledges the threat posed by fintech competitors trying to disrupt traditional banking.

Dimon's recognition of stablecoins marks a significant shift for JPMorgan Chase. As fintech rivals capitalize on digital innovations, traditional banks must adapt or risk losing market share. This initiative reveals a broader trend within the financial sector, where traditional institutions are beginning to embrace more flexible digital solutions rather than dismissing them. Dimon’s statements signal a cautious yet strategic entry into the stablecoin space, reflecting a significant industry evolution.

Highlights

- JPMorgan must innovate to stay relevant in the competitive finance landscape.

- Stablecoins could reshape how we understand digital payments.

- Dimon asks why use stablecoins when payment methods exist.

- Banking giants face pressure from fintech innovators.

Financial implications of JPMorgan's stablecoin strategy

JPMorgan's move into stablecoins may invite public scrutiny and regulatory challenges, as it balances innovation with traditional banking practices.

The future of stablecoins may redefine traditional banking practices.

Enjoyed this? Let your friends know!

Related News

Goldman Sachs and BNY unveil tokenized money market funds

Winklevoss criticizes JPMorgan's new data fees

SEC launches pro-crypto initiative under Paul Atkins

JPMorgan Chase stock falls despite Q2 earnings beat

Employees express dissatisfaction over gym fees at JPMorgan headquarters

Jamie Dimon recounts his firing and comeback story

JPMorgan's Jamie Dimon advises against bitcoin

JPMorgan to implement new fees for fintech access