T4K3.news

Intel chief resignation demand

Trump calls for Lip-Bu Tan to resign over ties to Chinese firms amid security and governance concerns.

Trump presses for Lip-Bu Tan to step down after concerns about investments in Chinese firms tied to CCP and PLA.

Trump demands Intel chief resigns over China links

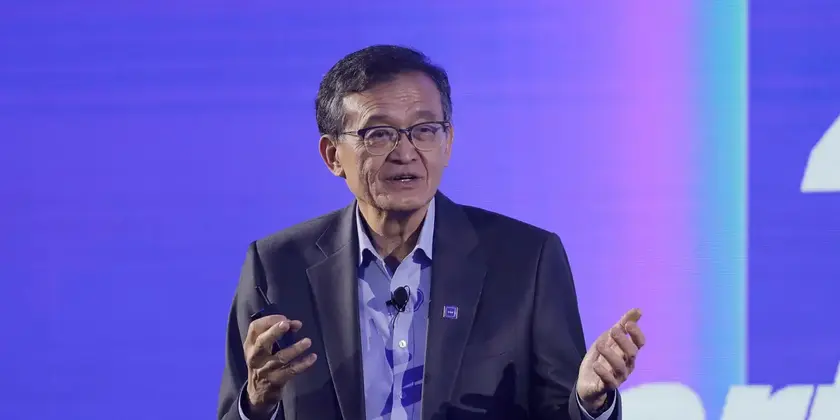

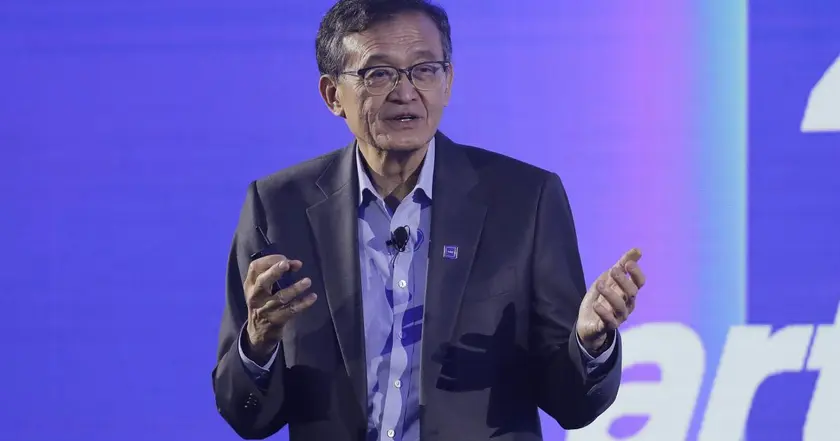

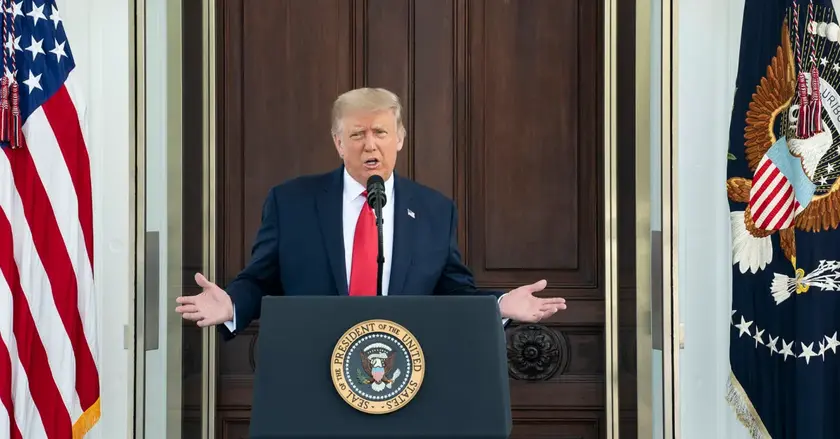

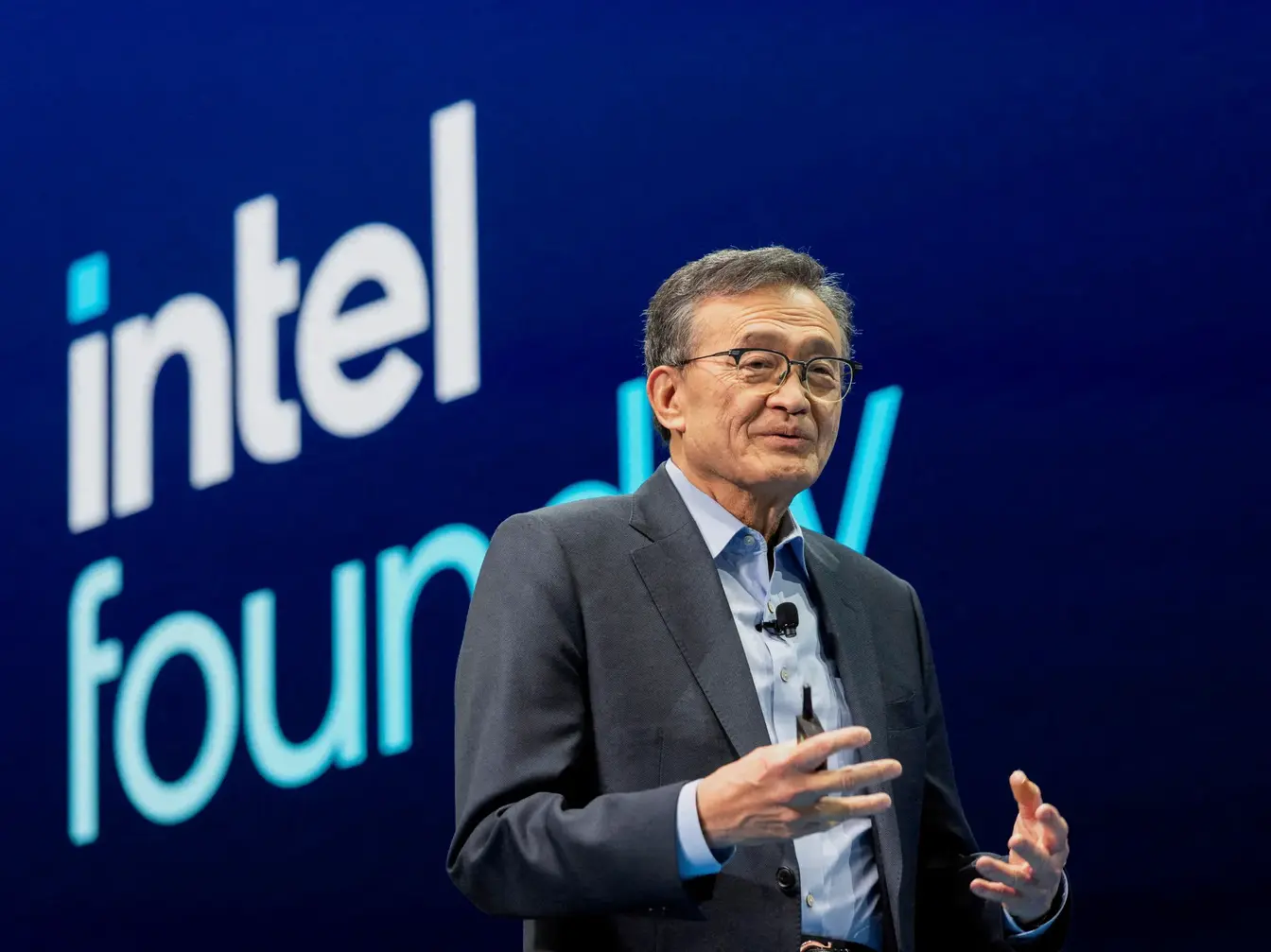

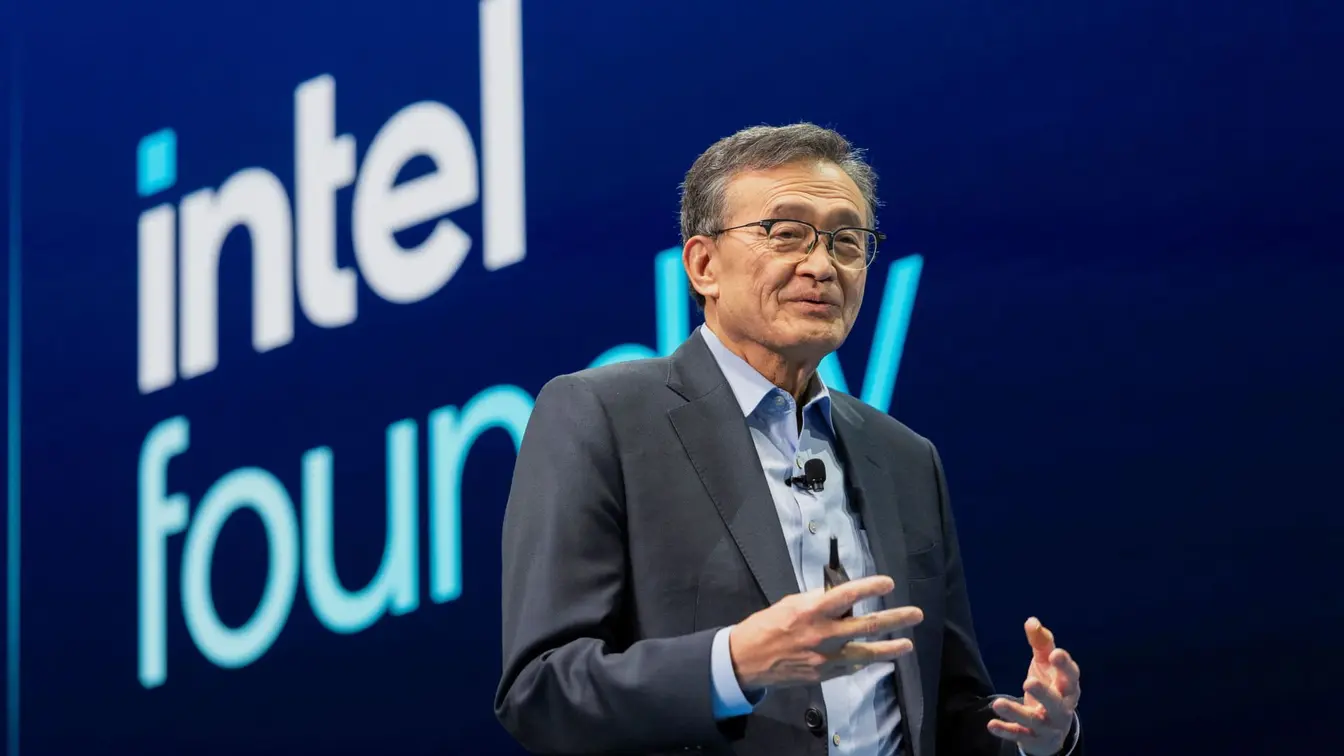

President Trump has called for Intel chief Lip-Bu Tan to resign, four months into his tenure at the faltering chipmaker. The demand came after Republican Senator Tom Cotton raised questions in a letter about Tan’s investments in semiconductor firms reportedly linked to the Chinese Communist Party and the People’s Liberation Army. Cotton asked whether the board had ensured divestment to remove any conflicts of interest.

The post on Truth Social frames the matter as a case of clear conflict that leaves no other solution but resignation. The incident adds to ongoing debates about how far board leadership should go to separate personal stakes from corporate strategy, especially in a sector as sensitive as semiconductors and as geopolitically charged as U.S.-China tech rivalry.

Key Takeaways

"The CEO of Intel is highly CONFLICTED and must resign, immediately."

Trump's post on Truth Social calling for Tan's resignation.

"There is no other solution to this problem."

Trump's assertion accompanying the resignation demand.

The episode underscores how political pressure can collide with corporate governance in critical industries. It tests Intel’s approach to conflicts of interest and the credibility of its leadership during a period of intense scrutiny over supply chains and national security. The broader trend is a push for greater transparency when private investments intersect with national security concerns, which could affect investor confidence and regulatory expectations.

Looking ahead, the case may force a reckoning on how quickly boards react to public concerns about foreign ties. The outcome could influence how other tech firms handle cross-border investments and governance disclosures in a world where political headlines move markets as fast as silicon chips.

Highlights

- Trust is earned in the open, not in the boardroom shadows.

- Leadership shows its mettle when borders shadow the balance sheet.

- Clear answers beat loud promises.

- Governance risks shape markets as much as technology does.

Political and governance risk

The call for a leadership change over foreign ties blends political pressure with corporate governance. This could trigger investor backlash and closer regulatory scrutiny while raising questions about disclosure and accountability.

Leadership credibility now hinges on transparent stewardship and swift, clear governance actions.

Enjoyed this? Let your friends know!

Related News

Trump demands Intel CEO resignation

Trump demands Intel CEO's resignation amid China investment concerns

Intel CEO Resists Resignation Demand

Trump demands Intel CEO resign over China ties

Trump calls for Intel CEO to resign over China ties

Trump demands Intel CEO resign amid stock drop

Intel foundry split urged by former directors

Trump demands Intel CEO resign over conflicts