T4K3.news

Google TV revenue under pressure

New report shows Google TV struggling to monetize ads amid fierce competition and shifting budgets

A new report portrays Google TV as struggling to monetize its platform amid stiff competition and shifting ad budgets.

Google TV faces revenue crunch amid ad market pressures

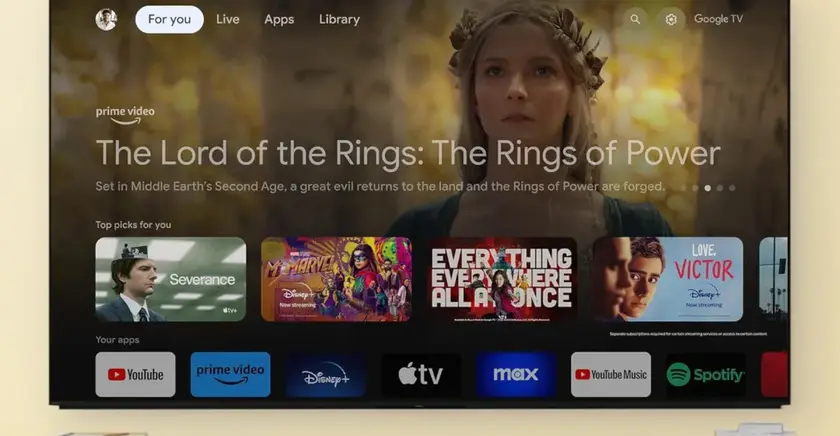

A recent paywalled report from The Verge highlights that Google TV has struggled to turn ad space on the platform into reliable revenue. Google reportedly reduced its commissions on ad slots to attract advertisers while facing growing costs, a move that signals stress behind the scenes as the company competes with Samsung’s Tizen, LG’s WebOS, Roku and Amazon’s Fire OS in the US. The effort to revive profits comes as Google merged its Android TV and Chromecast efforts in 2020 to boost discovery and engagement, yet monetization remains elusive.

The article notes Google’s market position is partly constrained by its own ecosystem and by how TV manufacturers control revenue streams. While about a quarter of new TVs worldwide ship with Google’s interface, much of that revenue comes from “operator tiers” customized by partners rather than direct Google licensing. In the US, Google TV faces stronger pressure from Samsung, LG and Roku, with Amazon now pushing Fire OS on competing devices and offering retailers incentives to push its platform. YouTube also captures a growing share of screen time on smart TVs, which the report says has cannibalized some Google TV ad revenue, contributing to internal budget cuts and layoffs within the Google TV team.

Key Takeaways

"Profit from TV ads will require more than impressions"

Editorial assessment of the revenue model

"YouTube accounts for 25% of streaming views in the US"

Data point cited from The Verge report

"Partnerships with manufacturers may provide relief but not a long term fix"

Editorial judgment on strategy

The episode underscores a broader point about ad-supported platforms: being first to surface content is not the same as being first to profits. Google TV’s struggle reveals how difficult it is to monetize open, discovery-based interfaces when viewers drift toward dominant ecosystems and when ad budgets swing toward more proven channels. The shift also exposes a tension within Google’s own family of products, as YouTube’s growing TV audience can siphon revenue away from Google TV. This dynamic raises questions about whether Google should double down on partnerships or rethink its long term monetization model for TV. Ultimately, the outcome will hinge on whether Google can turn engagement into durable ad revenue without sacrificing partner relations or user trust.

Highlights

- Ads without a clear return can hollow out a platform

- The living room market is crowded and patience wears thin

- YouTube on TVs reshapes Google's entire ecosystem

- Partnerships may fix the leak but not the business model overnight

financial and strategic risk for Google TV

The report points to rising costs, reliance on ad revenue, and competition that could pressure Google TV into short term, less protective partnerships. This combination raises the risk of instability for partners and potential backlash if the strategy is perceived as give-away of ad space.

The path forward will test whether Google can align ads with user experience and partner interests without losing ground to rivals.

Enjoyed this? Let your friends know!

Related News

Google TV struggles with ad sales and competition

CBS cancels Colbert's Late Show

Amazon stock drops 8.3% after disappointing earnings

Stocks Decline as Powell Shares Outlook on Interest Rates

Subscription savings in reach

Warner Bros. Discovery posts Q2 earnings

Amazon reveals plans for new James Bond film

Stock Markets Climb as Earnings Reports Approach