T4K3.news

Figma's IPO sees stock value leap to $45 billion

Figma launched on the New York Stock Exchange, quickly achieving a market cap of $45 billion.

Figma's impressive debut on the stock market ignites significant interest and activity.

Figma's stock skyrockets after notable IPO

Figma started trading on the New York Stock Exchange on Thursday, attracting immediate attention as its stock price surged between $101 and $112. Trading was briefly halted due to extreme market volatility, underscoring the stock's popularity. The company and its existing investors set the initial IPO price at $33 per share, but the demand far exceeded expectations, leading to a market cap of $45 billion. Users on X humorously shared their experiences with Robinhood, often receiving just one share instead of larger requested quantities. The rapid success of Figma's IPO marks a stark contrast to its previously failed acquisition attempt by Adobe, valued at $20 billion, which now appears as a minor detail in Figma's story.

Key Takeaways

"The rapid success of Figma’s IPO marks a stark contrast to its previously failed acquisition attempt."

This highlights how quickly the narrative can change in the tech industry.

"Investors often received fewer shares than requested through trading platforms."

This illustrates the friction between high demand and available stock levels.

Figma's IPO success reflects a broader trend of strong demand for tech stocks, particularly those that cater to remote and collaborative work tools, especially post-pandemic. The excitement around its debut not only emphasizes investors' eagerness to support innovative companies but also indicates a shift in market dynamics. As firms like Adobe look to acquire cutting-edge technology, Figma's growth illustrates that some companies can thrive independently, challenging the status quo of technology mergers and acquisitions. Additionally, the humorous interactions on social media showcase how retail investors are actively engaging with the market and share a collective experience.

Highlights

- Figma's IPO proves that demand drives success in the tech market.

- Retail investors share laughs as their orders come up short.

- Turning a failed acquisition into a thriving public debut is no small feat.

- Figma's rise reflects a growing market for innovative tech solutions.

Market volatility raises concerns for investors

The high volatility seen during Figma's IPO could signal potential instability in future trading sessions. Investors may face significant risks if similar patterns emerge in the market.

Figma’s journey could inspire many tech startups seeking independence.

Enjoyed this? Let your friends know!

Related News

Figma's Stock Price Soars Over 250% Post IPO

Figma IPO Leads to Billions for Index Ventures

Bitcoin Reaches New All-Time High

:max_bytes(150000):strip_icc()/GettyImages-2227392128-f95994034c8f47c38408febb9d015a6c.jpg)

Stock Markets Climb as Earnings Reports Approach

Lina Khan praises Figma’s successful IPO

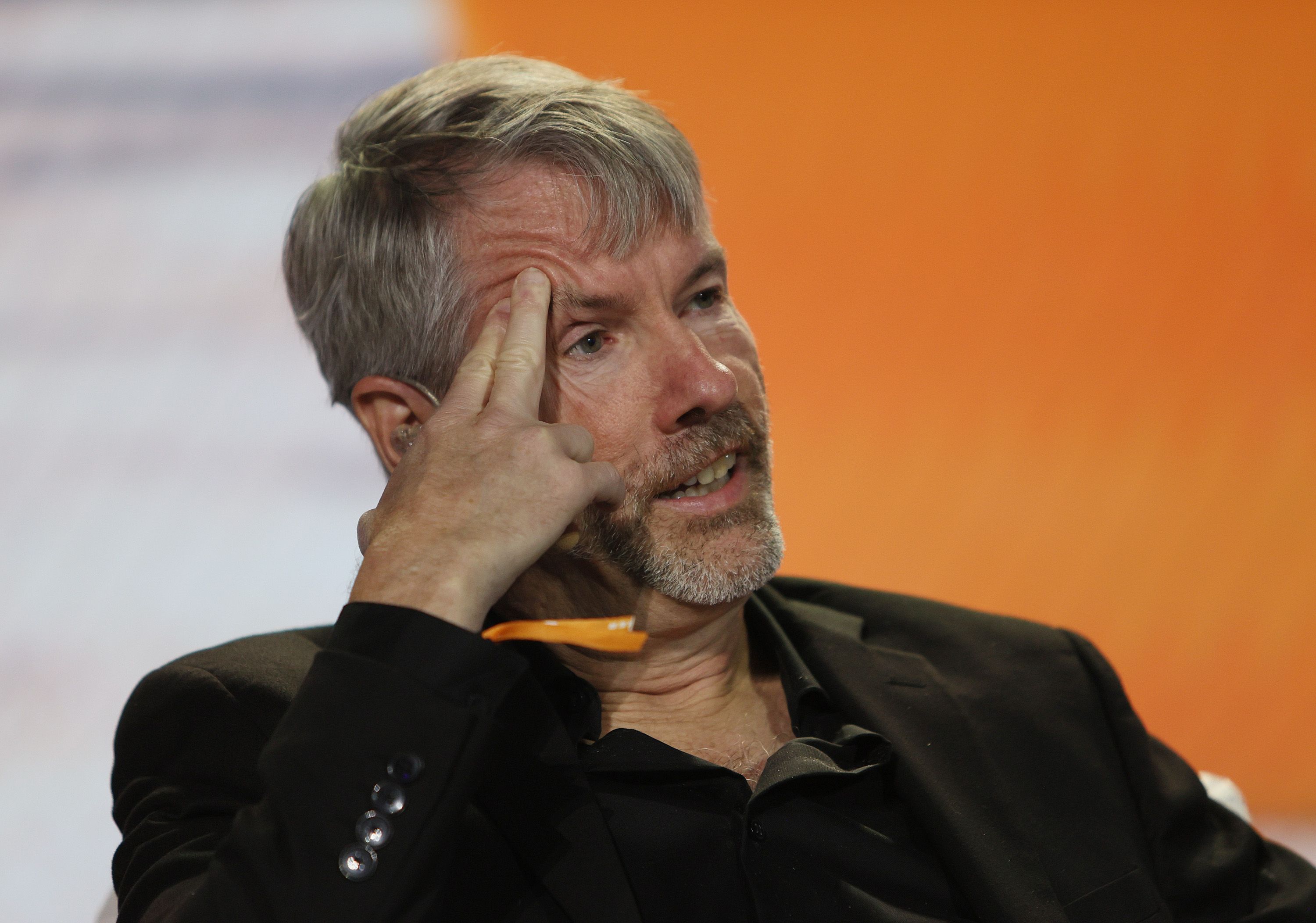

Michael Saylor Calls STRC a Game-Changer

Palo Alto Acquires CyberArk for $25 Billion

Marin Community Foundation nets $440 million from Figma IPO