T4K3.news

Fed official warns of economic turning point in jobs report

Federal Reserve Governor Lisa Cook pointed to alarming revisions in job growth that may signal economic shifts.

Federal Reserve Governor Lisa Cook expressed concerns about recent job revisions indicating economic shifts.

Fed official warns of economic turning point in jobs report

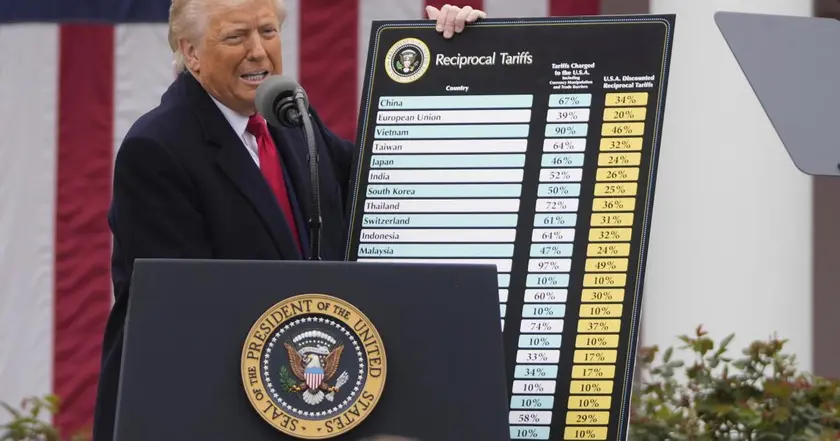

Federal Reserve Governor Lisa Cook expressed alarm over last week's disappointing jobs report, pointing to significant downward revisions in employment figures for May and June as signs of a potential economic turning point. The latest report revealed only 73,000 new jobs added in July, contrary to expectations, and a total of 258,000 fewer jobs were reported for the previous two months than initially thought. The revisions have fueled concerns of slowing economic growth. Additionally, Cook referred to an "uncertainty tax" that many business executives are facing due to macroeconomic conditions, including tariffs. Despite her caution, other Fed officials, such as Atlanta Fed President Raphael Bostic, suggested that the job market could still exhibit strength in the long run.

Key Takeaways

"These revisions are somewhat typical of turning points, which again speak to uncertainty."

Cook notes that job revisions can indicate significant shifts in the economy.

"When executives spend their time preparing for uncertainty, it's a deadweight loss in GDP."

Cook discusses the concept of an 'uncertainty tax' on businesses.

"We're going to see lower activity when we get the GDP numbers later this year."

Cook anticipates a decline in economic activity based on current job data.

"No matter the sector, businesses are discussing the uncertainty tax."

Cook highlights the widespread concern of uncertainty across industries.

This situation highlights a growing divergence in economic perspectives within the Federal Reserve. Cook’s emphasis on revisions as indicators of an inflection point has raised eyebrows, especially as some officials remain optimistic about the labor market's resilience. The concept of an "uncertainty tax" resonates strongly in the context of ongoing trade tensions and potential policy shifts under the current administration, making it crucial for policymakers to carefully assess emerging trends. The significant downward revisions not only illustrate the unpredictable nature of economic data but also underline the complexities that lie ahead for the U.S. economy. As companies navigate this uncertainty, their strategic responses will be fundamental in shaping future economic performance.

Highlights

- The downward revisions speak to a moment of uncertainty in the economy.

- This uncertainty tax is weighing heavily on businesses across all industries.

- There is a deadweight loss in GDP due to macroeconomic uncertainty.

- We must focus on where the economy is heading, not just where we have been.

Concerns over economic stability rise amidst job report revisions

The significant downward revisions in job estimates could lead to political and financial ramifications, affecting market confidence.

These revisions may reshape the Federal Reserve's approach to future economic policies.

Enjoyed this? Let your friends know!

Related News

Tariffs Elevate Stagflation Risk for Fed Policy

Widespread job cuts signal recession risk

US jobs report prompts recession fears

Economist warns U.S. economy faces recession risk

July jobs data boosts expectations for Federal Reserve rate cut

Trump's economic week critical for policy impact

Trump's tariffs lead to economic uncertainty in the U.S.

Mixed economic reports raise recession concerns