T4K3.news

ETH breaks 4000 as whales move big sums

Ethereum climbs past 4K as large holders move hundreds of millions in ETH, with supply near 121 million and staking offsetting issuance.

Ethereum climbs above 4K as large holders move hundreds of millions in ETH, with supply near 121 million and staking offsetting issuance.

ETH crosses 4000 as whale buying boosts price

Ethereum pushed past 4000, trading around 4196 at the time of writing as large wallets moved a combined 667 million in ETH from OTC desks, contributing to the price move.

Six new wallets reportedly coordinated the purchase, underscoring how a handful of players can influence near-term sentiment in a crowded market.

CryptoQuant data show circulating supply crossing 121 million ETH, a milestone reached after a long climb in issuance. Daily minting remains in the low thousands, while a significant portion of ETH is locked in staking to offset new supply.

Key Takeaways

"Whales shape the moment, not the destination."

editorial reflection on whale activity

"Staking reduces net issuance, yet inflation pressure remains uneven."

ETH supply and staking dynamics

"Momentum invites discipline; without it, a quick reversal lurks."

risk management

The move highlights how liquidity and on-chain activity interact with price action. A steady stream of staking continues to temper inflation, but the supply expansion remains a factor for ETH’s longer-term trajectory. Momentum indicators point to strong buying pressure, yet the setup carries the risk of a swift reversal if profit-taking accelerates or if liquidity dries up. In short, the story is evolving from a simple price push to a balance between demand, staking, and market sentiment.

Highlights

- Whales moving money shows liquidity, not a forever rally.

- Staking offsets issuance, but inflation pressure stays fragile.

- Momentum can lift prices fast, then pullback can arrive just as quickly.

- Demand must grow to sustain the rally beyond new highs.

Market sensitivity around whale activity

Large wallet movements can drive short-term price swings and affect sentiment; readers should be aware of the potential for sharp reversals and broader volatility.

Markets reward momentum but test discipline all at once.

Enjoyed this? Let your friends know!

Related News

ETH supply squeeze nudges ETH toward price discovery

Ethereum price and BTC dominance

Altcoins Show Signs of Potential Reversal Ahead

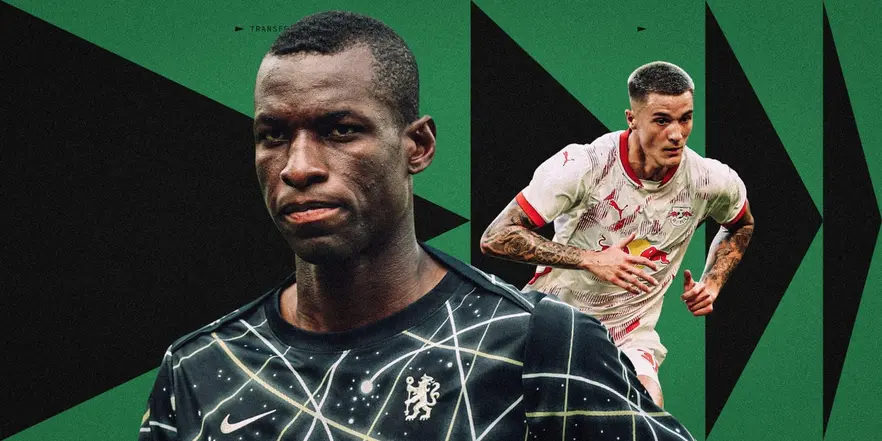

Transfer news intensifies as deadline approaches

Crypto market experiences sharp weekly gains and losses

Brewers claim top power ranking after trade deadline

New studies explore sunlight benefits for health

Bitcoin tops 122K after positive week