T4K3.news

CVC announces £9bn refinancing plan for sports assets

CVC Capital Partners launches a plan to refinance its extensive sports portfolio.

CVC Capital Partners seeks to optimize its sports investments through a new financing strategy.

CVC unveils refinancing plan for £9bn sports portfolio

CVC Capital Partners, the owner of major stakes in sports assets like Six Nations Rugby and women's tennis, is launching a refinancing effort valued over £9bn. The firm has engaged Goldman Sachs, PJT Partners, and the Raine Group to assist with the creation of SportsCo, a new entity designed to enhance its sports investments. This restructuring aims to raise new debt against one of the largest private equity-owned sports portfolios globally. CVC's strategy also involves exploring a minority stake sale in SportsCo or possibly pursuing an initial public offering. The investment firm has seen significant success in recent years, including a notable return from its Formula One deal and improved audience numbers in Premiership Rugby. The new approach is set to enable CVC to prolong its investment tenure while continuing to develop revenue streams across its sporting interests.

Key Takeaways

"CVC is plotting refinancing expected to value its sports portfolio at more than £9bn."

This fact highlights the significant financial scale of CVC's sports assets.

"CVC's investment strategy aims to maximize commercial potential through new media and sponsorship rights deals."

This reflects the company's efforts to adapt to changing consumer behavior.

CVC's refinancing plan highlights a growing trend among private equity firms to capitalize on lucrative sports investments. The creation of SportsCo underscores a strategic shift focused on cohesive support for diverse sports assets. This consolidation could lead to more streamlined operations and better financial performance but raises questions about the long-term implications for sports leagues’ independence. With shifting media trends and rising sponsorship revenues, CVC is positioning itself to not only navigate challenges but to seize future growth opportunities in an evolving sports landscape.

Highlights

- CVC's SportsCo strategy is set to redefine sports investments.

- Refinancing could lead CVC into new financial territories.

- Longer investments signal CVC's commitment to sports growth.

- The sports sector is ripe for private equity innovation.

Financial risk associated with large investments

CVC's substantial portfolio financing could attract scrutiny or backlash from investors and sports communities if mismanaged.

As the sports investment landscape evolves, CVC's strategy could define new industry standards.

Enjoyed this? Let your friends know!

Related News

ESPN acquires NFL media assets in landmark deal

World Black Pudding Throwing Championship cancelled

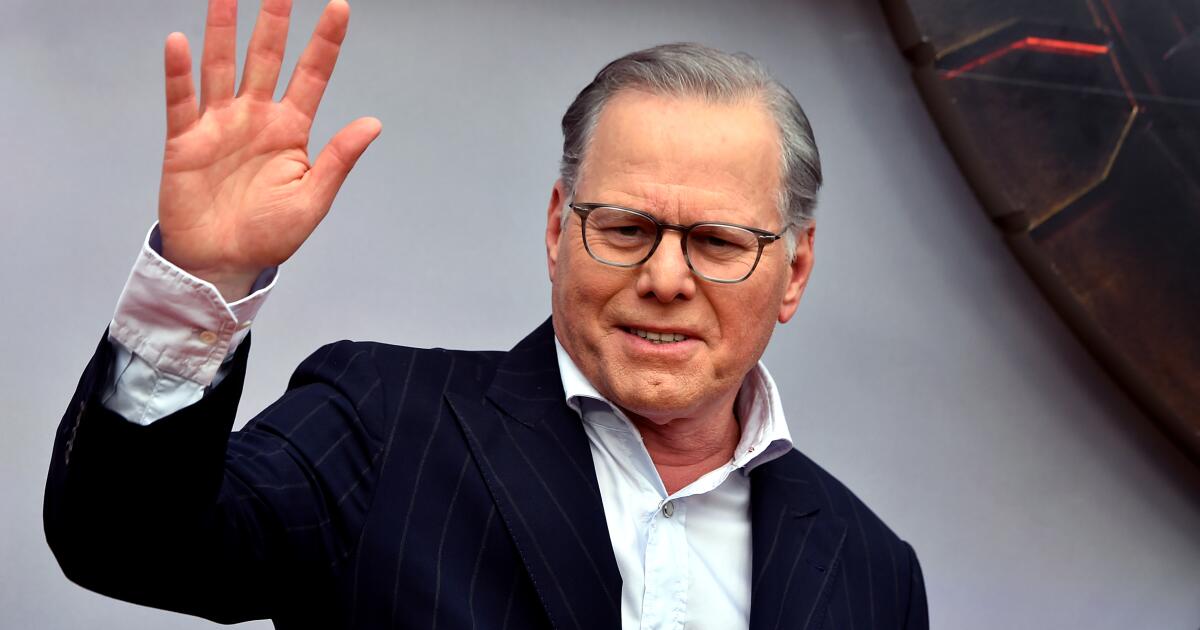

Warner Bros. Discovery unveils corporate split plan

Comcast Reveals Board for Versant Media Group

Trump Media Secures $2 Billion in Bitcoin Holdings

Dana White announces UFC event at the White House

Trump Media announces $2 billion Bitcoin investment

Starmer's sanctions plan announced