T4K3.news

Citi launches new premium card Citi Strata Elite

The Citi Strata Elite Card offers unique benefits and a high annual fee, targeting frequent travelers.

The Citi Strata Elite has entered the market with a mix of exclusive perks.

Citi unveils premium card Citi Strata Elite with unique benefits

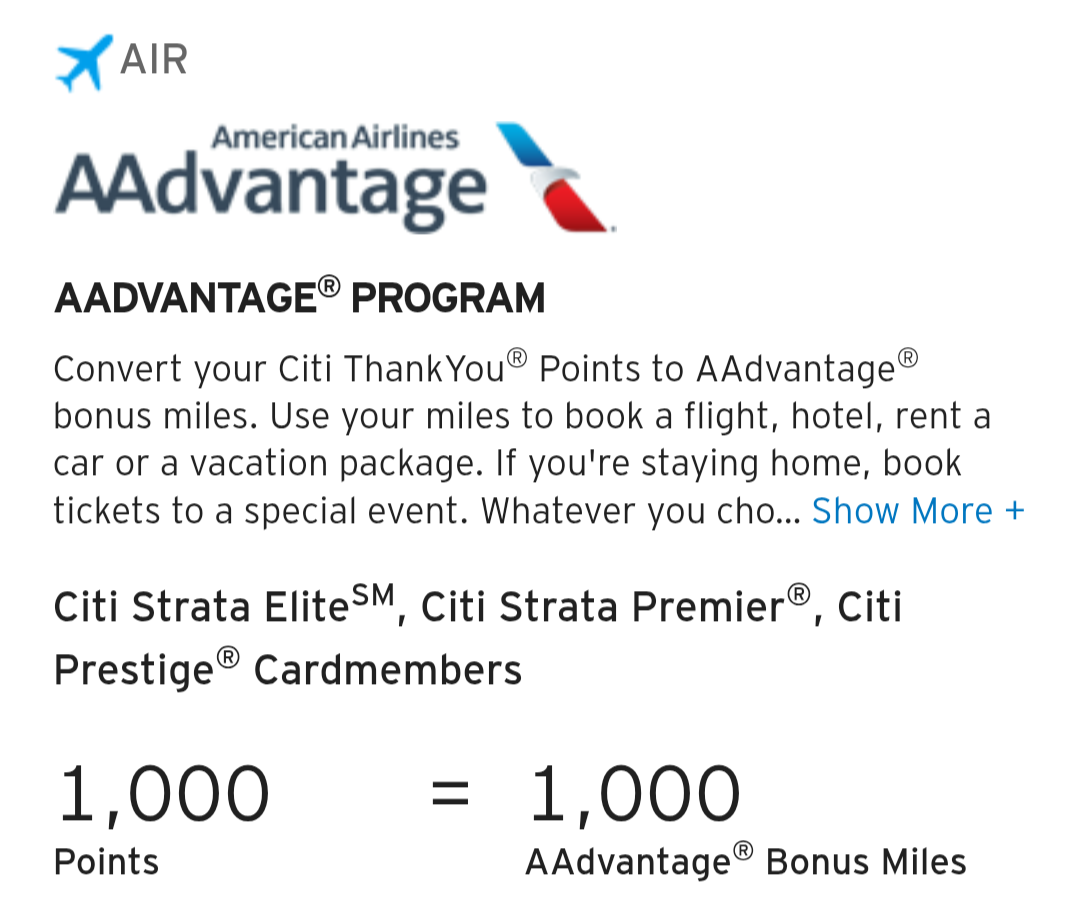

Citi launched its long-awaited Citi Strata Elite Card, marking the first major update since the Citi Prestige Card. Available for an annual fee of $595, the Strata Elite includes over $800 in statement credits and offers unique features like Admirals Club lounge access. Cardholders can earn considerable rewards for spending through Citi's travel portal, such as 12 points per dollar on hotels booked within that portal. Citi has also partnered with American Airlines, allowing for a 1:1 points transfer to AAdvantage miles, a feature that strengthens its appeal to frequent flyers. Authorized users can be added for $75, giving them access to similar benefits.

Key Takeaways

"The card offers over $800 in statement credits and several travel protections."

This highlights the card's high value compared to its cost.

"Citi's attempt to align a premium card with its long-standing airline partner is key."

Understanding the partnership's implications helps assess the card's appeal.

"Depending on your travel habits, this card may have been worth the wait."

This reflects on the mixed reception of the card among users.

"Travel booked directly earns 1 point per dollar spent, which makes it hard to maximize rewards."

This is a significant drawback for many users who prefer direct bookings.

While the Citi Strata Elite introduces several attractive features, it raises concerns about its alignment with traveler needs. The $595 fee may deter casual users, and its earning rates heavily favor purchases made through Citi's travel portal. This shift could alienate users who prefer to book travel independently. The benefits tied to dining and weekend spending present an innovative approach, though the card falls short against competitors like Amex and Chase when it comes to direct travel bookings. Citi aims to create a niche market, but potential users need to weigh if the benefits outweigh the cost in their specific travel context.

Highlights

- Frequent travelers may finally welcome Citi's unique card offerings

- Are travel rewards worth the new annual fee of $595?

- Citi aims for travelers but does it truly fit your strategy?

- Admirals Club membership perks add significant value to the card.

Potential risks with Citi Strata Elite card utilization

The high annual fee and restrictions on earnings for direct travel bookings may alienate potential users. Travelers not aligned with American Airlines might find this card less beneficial, prompting concerns for general appeal.

As the credit card landscape evolves, Citi's strategic choices may determine its standing among elite travel cards.

Enjoyed this? Let your friends know!

Related News

Citi launches point transfers to American Airlines

Citi teams up with American Airlines for credit card transfers

Nintendo Switch 2 Pokémon Legends Z-A Bundle Available for Preorder

Delta's Sky Club lounges face overcrowding issues

Nintendo Switch 2 invites are now available

R-Type Delta HD Boosted to Launch in Japan

Southwest Airlines to introduce assigned seating