T4K3.news

Bite turns into medical debt

Massachusetts woman faces $20k hospital bill after bat exposure in Arizona, sparking questions about health coverage and safety nets.

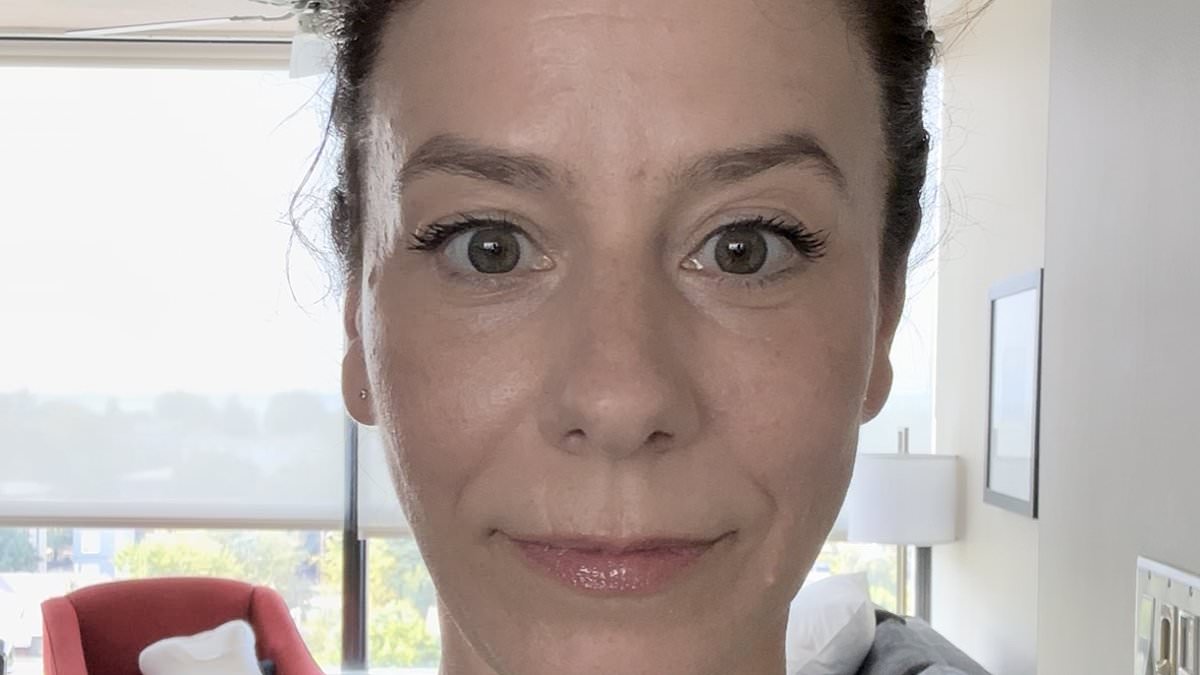

A Massachusetts woman faces thousands in medical bills after a bat bit her mouth during a trip to Arizona, highlighting gaps in insurance and the cost of post exposure care.

Bat bite case exposes medical debt risk

In Horseshoe Bend, Arizona, a wild bat wedged itself between a traveler’s camera and her face during a night photo session. The incident led Erica Kahn to seek emergency care for post exposure prophylaxis after potential rabies exposure. She was briefly uninsured following a layoff and bought a policy the day after, only to learn it carried a 30 day waiting period before benefits kicked in. After four hospital visits and seven rabies shots, the medical bill totaled $20,749.

Public health guidance notes that bats are a common source of rabies in the United States and that exposure can be minor but still requires urgent care. Post exposure treatment costs can run into thousands before hospital charges. Kahn started a GoFundMe with a goal of $12,000 and has pledged to donate half of the proceeds to UNICEF. She regrets not staying on COBRA but says the care costs were extreme. She remains hopeful about paying down the debt while keeping a sense of humor about the ordeal.

Key Takeaways

"Life saving care should be a basic right not a fundraising request."

GoFundMe page and public response

"A 30 day waiting period turns a medical emergency into a debt crisis."

insurance coverage gap analysis

"We need a safety net that works when you need care not when you can pay."

editorial perspective on policy

"The cost of care should not decide who lives to tell the tale."

policy critique on healthcare costs

The incident underlines how gaps in health coverage can turn a medical scare into a financial crisis. A waiting period for benefits means patients may face large bills before any insurance pays. It also shows how crowd funding, while helpful, is not a substitute for a reliable safety net. The case raises questions about COBRA gaps, employer protections and broader coverage reforms that could prevent similar debt spirals. It signals a political and financial crossroads for policymakers who must balance affordability with urgent medical needs.

Highlights

- Life saving care should be a basic right not a fundraising request.

- A 30 day waiting period turns a medical emergency into a debt crisis.

- We need a safety net that works when you need care not when you can pay.

- The cost of care should not decide who lives to tell the tale.

Health policy and financial risk

The piece connects a personal medical event to broader issues of health insurance gaps, COBRA coverage limits, and the financial burden of post exposure care. It highlights potential political and budget implications and may invite public debate over safety nets.

A safer health system would protect people when care is needed, not after they pay.

Enjoyed this? Let your friends know!

Related News

Exploring GLP-1 medications and their implications

Woman requires 37 stitches after dog attack

Iowa Teen Recovers from Serious Spider Bite Infection

Vaccine injury spurs class action

Ranking all FBS programs for the 2025 season

Man faces £150,000 in medical costs after Lyme disease diagnosis

Older workers face growing financial pressure

Bristol jogger needs medical care after dog bite incident