T4K3.news

Bitcoin prepares for a potential surge as September approaches

Bitcoin nears a critical phase with the potential for significant gains if the Fed cuts rates.

Market signals suggest Bitcoin could be set for a strong performance as Q4 approaches.

Bitcoin prepares for a potential surge as September looms

Bitcoin approaches a crucial phase as its strongest seasonal period nears in Q4. Traditionally, this quarter has delivered an average return of 85.4% for BTC. A critical factor this year is the anticipation of a 50 basis point Federal Reserve rate cut in September. Such a shift in monetary policy typically encourages risk-on investments, and BTC stands to gain significantly if this occurs. Currently priced between $110,000 and $115,000, Bitcoin could see a sharp increase if it flips the $125,000 level into support in the coming months. However, seasonality trends in August and September may restrict immediate upside potential, requiring careful observation of market conditions.

Key Takeaways

"Historically, October–November have been BTC’s highest-beta window, averaging a combined return of +67.91%."

This quote highlights Bitcoin's historical performance during Q4, indicating its potential for rapid gains.

"In the past, Fed easing cycles have consistently fueled risk assets, and BTC has been a major beneficiary."

This underscores the strong relationship between Bitcoin's performance and Federal Reserve policies, pointing to future potential.

"If BTC wants to replay its typical Q4 expansion, it’ll need to flip the $125K level into support."

This statement illustrates the immediate technical challenges Bitcoin faces en route to significant price milestones.

"A rate cut could align almost perfectly with Bitcoin’s strongest historical momentum phase."

This indicates the potential timing for Bitcoin's performance boost based on economic signals.

The potential for a Bitcoin rally heavily hinges on external economic conditions, particularly the Federal Reserve's monetary policy decisions. With September acting as a pivotal month, traders must remain vigilant. The historical performance of Bitcoin in Q4 highlights the asset's tendency to surge when macroeconomic indicators favor riskier assets. As Bitcoin navigates these challenges, the upcoming rate cut could not only solidify its support level but also propel it toward unprecedented heights. Should market participants engage positively, we might witness a significant shift in Bitcoin's trajectory.

Highlights

- Bitcoin's Q4 potential hinges on a pivotal rate cut.

- If the Fed cuts rates, Bitcoin's trajectory might change for good.

- September could shape Bitcoin's financial landscape for years.

- $200,000 Bitcoin is not just a dream, but a looming reality.

Potential market volatility due to monetary policy changes

The anticipated Federal Reserve rate cut may trigger significant market reactions, potentially leading to volatility in Bitcoin prices.

Bitcoin's future hinges on economic developments and investor sentiment in the coming weeks.

Enjoyed this? Let your friends know!

Related News

Fed rate cut chances drop significantly

Bitcoin volatility drops to 70% amid declining market activity

Bitcoin reaches record high ahead of Trump's inauguration

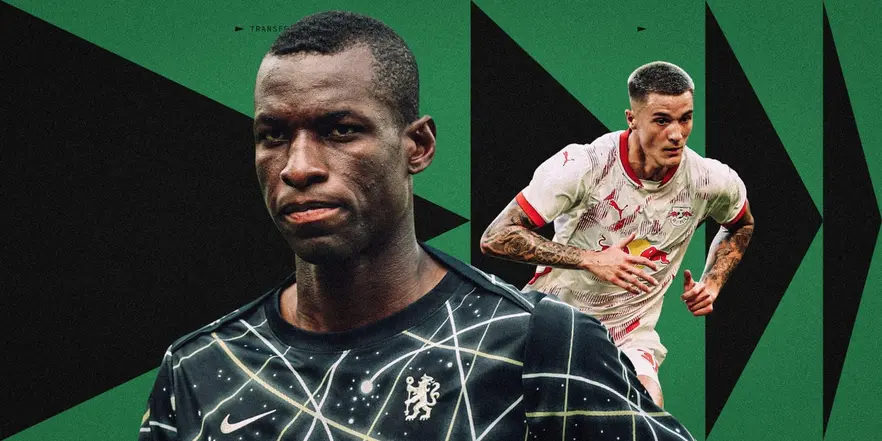

Transfer news intensifies as deadline approaches

Ethereum shows signs of potential correction

Liverpool could finalize multiple transfers this week

Authorities prepare for protests across England this weekend

Uniswap responds to SEC's legal challenges