T4K3.news

AstraZeneca invests $50 billion in US by 2030

The company plans to build a new manufacturing facility and expand research in several US states.

UK company to fund new drug manufacturing facility in Virginia and expand R&D facilities around US

AstraZeneca commits $50bn to US investment by 2030

AstraZeneca has pledged to invest $50 billion in the United States by 2030, targeting the construction of a new drug manufacturing facility in Virginia and expanding research and development operations across several states, including Maryland and California. This decision responds to potential tariff threats from former President Trump, who has indicated tariffs of up to 200% on importation of pharmaceuticals. Howard Lutnick, the US commerce secretary, noted that this investment will bring substantial pharmaceutical production to the US, potentially generating tens of thousands of jobs.

Key Takeaways

"We are proud that AstraZeneca has made the decision to bring substantial pharmaceutical production to our shores."

This statement from Commerce Secretary Howard Lutnick highlights the expected economic impact of AstraZeneca’s investment.

"The $50 billion investment will support our ambition to reach $80 billion in revenue by 2030."

AstraZeneca CEO Pascal Soriot stresses the growth potential of the investment.

AstraZeneca's considerable investment reflects a growing trend among multinational pharmaceutical companies to relocate operations to the US. This strategic decision is clearly influenced by the political landscape, particularly Trump's tariff threats aimed at reducing reliance on foreign manufacturing. If successful, AstraZeneca could enhance its revenue significantly in North America, while also facing increasing scrutiny over pricing and supply chain ethics.

Highlights

- AstraZeneca's $50 billion bet on the US reflects urgent market shifts.

- Will Trump's tariffs reshape the American pharmaceutical landscape?

- Thousands of jobs hinge on AstraZeneca's ambitious investment plan.

- The future of US-made drugs is at stake amidst rising political tensions.

Political and Economic Risks Involving AstraZeneca's Investment

AstraZeneca's commitment faces uncertainties due to potential political backlash over tariffs and pricing regulations. The company's potential shift of its stock market listing from London to New York could also impact UK investors and the economy.

This investment marks a significant shift in the pharmaceutical landscape, further intertwining it with US economic goals.

Enjoyed this? Let your friends know!

Related News

AstraZeneca announces $50 billion U.S. investment

AstraZeneca reports strong Q2 earnings

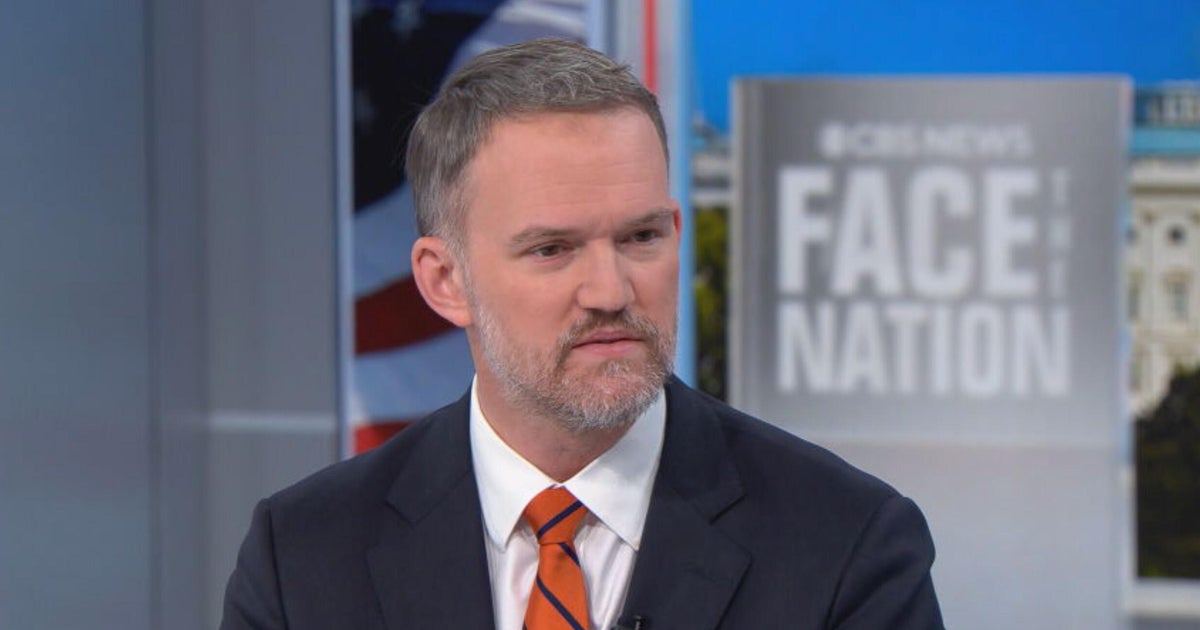

U.S. Tariff Strategy Discussed on Face the Nation

FTSE 100 share index reaches 9,000 points

D.C. City Council approves stadium deal for Commanders

UK borrowing exceeds £20bn in June

Stellar's Price Set for Rise After Trump's Crypto Bill

TSG Consumer Partners Acquires Indie Fragrance Brand Phlur